On April 30, 2018, the Hong Kong government published its first Money Laundering and Terrorist Financing (ML/TF) Risk Assessment Report. The publication of the risk assessment precedes an expected Financial Action Task Force (FATF) mutual evaluation review of Hong Kong later this year.

The assessment report concludes that Hong Kong is subject to a medium-high level of money laundering risk and a medium-low level of terrorist financing risk. The report rates the jurisdiction’s ability to combat these risks as medium-high based on “a robust legal framework, high-level political commitment, close partnerships among government agencies and between the public and private sectors, fair and efficient prosecution and judicial process, and good external and international cooperation.” That said, the report does identify gaps and recommends implementation of the following legislative actions (some of which are already underway) to address these gaps:

- Extends customer due diligence (CDD) and recordkeeping requirements to Designated Non-Financial Businesses or Professions (DNFBPs)

- Requires the collection and maintenance of beneficial ownership information for companies incorporated in Hong Kong

- Introduces a requirement for a declaration/disclosure system for cross-border movement of Currency and Bearer Negotiable Instruments (CBNIs)

- Enhances mechanisms for freezing terrorist property and prohibiting the financing of travel of foreign terrorist fighters

- Implements additional sanctions against North Korea

In addition to the foregoing, the report emphasizes Hong Kong’s commitment to continued strengthening of supervisory and law enforcement initiatives as well as outreach and awareness programs.

While the assessment does not include any surprises for those knowledgeable about the Hong Kong market, the sectoral risk assessments included in the report are instructive to covered financial institutions.

Overview Assessment of the Financial Services Industry

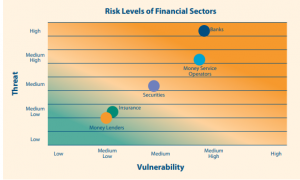

The report assesses the risks of five sectors in the financial services industry: banking, securities, insurance, money services operators (MSOs) and money lenders. The first four of these sectors are covered by Hong Kong’s Anti-Money Laundering and Counter-Terrorist Financing (Financial Institutions) Ordinance (AMLO), which has been in place since 2012, and are subject to supervision by the relevant authorities. The fifth sector, money lenders, is regulated by the Money Lenders Ordinance (MLO), which dictates, among other things, licensing requirements, requirements for transparency and clarity of loan terms, and the prohibition of excessive interest rates.

The report summarizes the threat level and vulnerability of each of the five sectors using the following graphic:

Highlights from the individual sector assessments include the following:

Banking

Key threats and vulnerabilities for the banking sector include the following and arise from Hong Kong’s role as a major financial center as well as from its connectedness with mainland China:

- Transactional crime syndicates using the banking sector as a conduit for moving illicit funds

- Vulnerabilities to terrorist financing, sanctions related to the proliferation of weapons of mass destruction, and other financial sanctions stemming from Hong Kong’s status as a global and regional financial processing hub

- Increased risks (e.g., tax evasion and corruption) associated with Hong Kong’s development as a wealth management center

- Emerging cybercrime threats not unique to Hong Kong

The regulatory and supervisory framework for banking is considered mature, but with an acknowledgment that the Hong Kong Monetary Authority (HKMA) will continue to work to enhance its ability to test complex technology-related systems, ensure consistency in its risk-based approach to supervision, strengthen its understanding of new typologies, and improve its coordination with other local and international regulators.

Securities

As one of the world’s most active and liquid securities and futures markets, Hong Kong is exposed to both domestic and transnational risks. Since the market generally does not accept or use cash, the sector is primarily at risk of layering and integration. Threats come in the form of:

- Securities-related offenses (e.g., market manipulation)

- Non-securities-related offenses (e.g., using illicit monies to fund a securities account)

To assess vulnerability, the report deconstructs the securities into four sub-sectors, which are rated separately:

| Sub-Sector | Vulnerability Rating | Examples of Risk |

| Brokerages | Medium | Third-party payments

Non-face-to-face contact/cyber risk Exposure to high risk clients (e.g., politically exposed persons, or PEPs) |

| Asset Managers | Medium-low | High percentage of foreign investors

Exposure to high-net-worth customers |

| Advisers on Investments | Medium-low | Risk of tax evasion |

| Advisers on Corporate Finance | Low | Limited to breakdown in normal CDD requirements |

Notwithstanding the lower vulnerability of securities firms, the government’s Securities and Futures Commission (SFC) has identified and continues to address deficiencies in monitoring, evaluation and reporting of suspicious transactions. Given the growing number of securities firms that are subsidiaries of mainland China financial groups, the SFC has also been working cooperatively with mainland China regulators to educate the industry on the risks. In addition, the SFC is committed to improving the resilience of the securities sector to cyber risks, monitoring and addressing any emerging risks stemming from the use of electronic certification services or other financial technology, and further improving its industry awareness efforts.

Money Services Operators

Given the cash-intensive nature of its business, cross-border activity and walk-in, one-off transactions, the MSO segment has a medium-high risk of exposure to money laundering and terrorist financing, though the threats and vulnerabilities do vary in terms of the size and business models of the market participants. Unlicensed MSOs also pose a risk to the market.

Despite an uptick in suspicious transaction reporting (STR) over the last five years indicating improved awareness, the government’s Customs and Excise Department (C&ED) – the primary regulator for this sector – is committed to enhancing its supervisory efforts by:

- Continuing to assess the AML/CTF knowledge of MSOs and providing compliance programs that are tailor-made for the sector

- Improving the sector’s understanding of technology used to identify suspicious activity as well as improving the quality of STRs

- Ensuring proper implementation of compliance programs

- Conducting a thematic review of MSOs to facilitate the formulation of more targeted mitigating controls.

Insurance

The insurance industry in Hong Kong is one of the most open insurance centers in the world. Thus, there is an inherent risk of money laundering in the sector. However, the identification of insurance-related money laundering cases to date has been negligible, leading to an overall assessment of the risk as medium-low.

The insurance sector in Hong Kong is experiencing significant growth in individual long-term business premiums from offshore clients, 80 percent of whom (based on 2016 information) are mainland China visitors (MCV). MCVs take out insurance policies in Hong Kong for life protection, savings, children’s education, critical illness coverage, retirement and investment.

They turn to the Hong Kong market for a number of reasons, including the effective legal and regulatory mechanism, lower premiums (due to the lower mortality rate compared with mainland China), wider choice of products, and/or attractive product features and better policy returns. This activity has led to increased coordination between Hong Kong’s Insurance Authority (IA) and its mainland China counterpart and stepped up efforts by the IA to ensure that these products are sold and underwritten in accordance with Hong Kong standards.

As part of its continuing responsibilities, the IA is also committed to further strengthening coordination with its mainland China counterpart, monitoring industry trends and mitigation measures, and identifying emerging risks.

Money Lenders

Common money-laundering typologies for this sector include:

- Use of loans or mortgages to layer and integrate illicit funds into the purchase of high-value real estate

- Lump-sum cash repayments or smaller “structured” cash amounts used to repay loans

According to the assessment report, neither of these methods has been prevalent in Hong Kong, and there is little evidence this sector is used by criminals to launder illegally gained funds. Rather, the most prevalent predicate offense is fraud related to the use of false instruments to obtain a loan. As a result, the money laundering threat in this sector is considered medium-low.

Going forward, the Hong Kong police force and the Registrar of Money Lenders will focus on ensuring that only fit and proper persons obtain money lender licenses and that their supervisory and outreach efforts continue to raise awareness of the risks.

* * * *

Given the impending FATF review, financial institutions should familiarize themselves with all aspects of the Money Laundering and Terrorist Financing Risk Assessment Report and be prepared to explain how the specifically identified risks have been addressed in their institutions.

For more information on money laundering and terrorist financing risks, visit www.protiviti.com/AML.

Add comment