Fintech companies have had great success in the lending sector of the financial services industry because customers are more comfortable with being in control when borrowing money than when they are handing over their own money. This fact leads to a point I emphasized recently at a media breakfast in London to talk about the impact of digitalization on the wealth and asset management sector as discussed in Roubini ThoughtLab’s report titled Wealth & Asset Management 2022: The Path to Digital Leadership, which Protiviti co-sponsored: Combining digital experiences with the ability to build trust will be a big challenge and the big differentiator for the winners in the wealth and asset management sector.

As a long-term, relationship-based business, the wealth management sector historically has been on the slower end of innovating and embracing change. However, with the impending wave of wealth transfer expected over the next two decades, the industry has recognized that its client base is changing, and leaders are putting digital transformation high on the agenda. Today, only 2.3 percent of the firms surveyed are “digital leaders” (as defined in the survey), but over the next five years, 20 percent of firms say they expect to be digital leaders, and a further 47 percent expect to be digitally mature.

Digital leaders are defined as those companies that place digital at the core of their business model and operations, with strong leadership and an innovative culture. They are also data-friendly and have embraced the cloud.

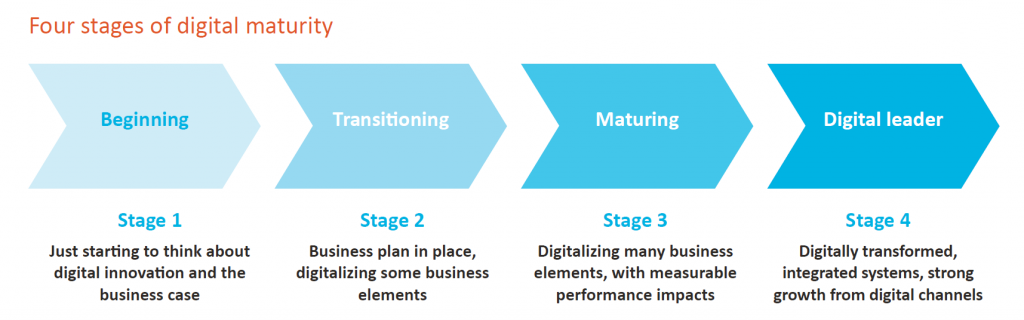

My colleague Jonathan Wyatt, the global head of Protiviti Digital, shared with the audience at the event the four stages of digital maturity, from beginner to digital leader (as shown in the graphic below). As set out in the report, there are eight steps to digital leadership: Firms need to begin with a digital vision and a business case, and then map out a clear path to digital transformation while nurturing a culture of innovation, driving continuous product development and building an omni-channel customer experience. Firms also need to stay ahead of the technology curve and develop digital talent while ensuring cybersecurity stays airtight.

One question asked at the event was whether it would be more advisable for some companies to be “followers” rather than digital leaders, at least in this relatively early development phase. Jonathan responded that it may be a good business decision for some companies to become “fast followers” but he warns that even those organizations need the technology in place to enable that business model. “Most companies have huge legacy infrastructures that are inflexible and are slow to change,” he said. “To be able to respond quickly to the changing market and competitive environment, firms need to be digital to the core to position the business to be a fast follower.”

I want to add that there is absolutely a benefit to being an early mover but that needs to be conducted in an intelligent and controlled manner. If firms wait too long, they will need to spend more and suffer the risk of being viewed as a “digital laggard” by their customer base, potentially losing market share to more flexible rivals. However, firms should be careful not to wipe out all of their legacy systems at once but approach their digital journey in stages – a point I made in the Roubini report as well.

The demographic shift in wealth to the millennial generation will force a change in how to conduct business. Many millennials don’t want to talk on the telephone or in face-to-face meetings, which wealth managers have traditionally used; they would much rather use their smart phones and chatbots for interaction. There is already a move to the omni-channel, as the survey shows; this will increase as advisors start to lose market share to new companies whose digital platforms make it easier to sign up. Of course, there will always be customers who prefer to speak to a human, and the pricing model will likely continue to evolve to reflect these preferences. Human contact will become more expensive. Chatbots will begin to feel more human-like as the technology advances and becomes much cheaper and more efficient.

Even as fintechs invade the sector, large institutions will not stand idly by and watch while their trillions of dollars of market share evaporates. In cases where they can’t develop the technology fast enough, or somebody has already figured it out, large institutions can buy that acceleration, either through direct investment or through acquisition of the startups.

Regardless of the specific digital journey scenario, firms need to ensure that their cybersecurity remains airtight if they are to succeed in building customer trust. Digital innovation, third-party fintech partnerships and acquisitions, cloud adoption and core renewal projects all need to build in controls and safety valves from a cyber risk perspective, not the least to comply with new and evolving global cybersecurity rules and regulations. Robust cybersecurity, efficiency, flexibility and proven returns are the keys to solving the customer trust equation on the path to digital leadership.

The Wealth & Asset Management 2022: The Path to Digital Leadership report expands on many of these issues, with responses from over 1,500 participants and commentary from 42 high-ranking executives sharing their thoughts on the path to digital transformation. I strongly encourage you to read it, and engage in the conversation sooner rather than later to ensure your firm is not left behind on the digital journey.