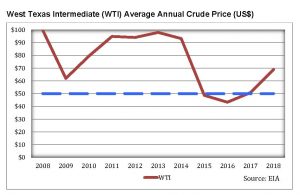

With sub-$50-per-barrel risk largely subsided, optimism abounds in the oilfield. (See figure.) Recent billion-dollar deals like Concho Resources’ $9.5B acquisition of RSP Permian and Devon Energy’s $3.125B divestiture of its stake in EnLink Midstream may put pressure on others to make deals to stay competitive. While certain deals are relatively safe, such as land swaps in the Permian basin, others come with significant risk, as evidenced by the failed $746 million merger between SandRidge Energy and Bonanza Creek Energy. Your institution can avoid a dry hole in M&A by ensuring that the playbook meets sound practice standards in three areas: governance, resource mobilization and positioning for scale.

With sub-$50-per-barrel risk largely subsided, optimism abounds in the oilfield. (See figure.) Recent billion-dollar deals like Concho Resources’ $9.5B acquisition of RSP Permian and Devon Energy’s $3.125B divestiture of its stake in EnLink Midstream may put pressure on others to make deals to stay competitive. While certain deals are relatively safe, such as land swaps in the Permian basin, others come with significant risk, as evidenced by the failed $746 million merger between SandRidge Energy and Bonanza Creek Energy. Your institution can avoid a dry hole in M&A by ensuring that the playbook meets sound practice standards in three areas: governance, resource mobilization and positioning for scale.

The importance of M&A to strategic growth might lead you to assume that most deals achieve their deal thesis. In reality, there is an astonishing 70 to 90 percent failure rate. Why? Opportunity No. 1 — governance. Few firms have a board-approved, annually updated M&A policy describing the scope, objectives, risk appetite and responsibilities of stakeholders across the firm. Even fewer firms have a documented deal lifecycle and corresponding standard operating procedures (SOP) (e.g., see Protiviti’s MAD lifecycle). Consequently, the thesis for doing a deal is lost on the resources responsible for delivering the outcome.

Which brings us to Opportunity No. 2 — resource mobilization. We find many organizations are slow to mobilize the right people. In fact, few have an M&A center of excellence (COE) empowered to orchestrate M&A preparation and execution. Our experience suggests that the lack of a COE correlates with inefficient onboarding of talent to the integration or divestiture initiative, subpar training, ineffective change management and communications, and missed opportunities for capturing improvements.

Few organizations can meet their growth plans absent acquisitions and, hence, know that they must be positioned for scale — Opportunity No. 3. Integrations go more smoothly when an organization’s infrastructure is prepared for scale, less so when deal leaders intend to leverage the infrastructure of a target (e.g., an ERP system). Stealing from Louis Pasteur’s famous quote, “Chance favors the prepared mind,” organizations with successful M&A deals know that chance favors the prepared infrastructure. Consider instituting these best practices to increase your chances:

- Have a customer “jobs lexicon” road map to facilitate gap analysis of a potential target’s customer offerings against your vision.

- Maintain storyboards and road maps for key middle- and back-office capabilities (e.g., a domain-driven architecture).

- Document key processes and controls, including functional interdependencies.

- Keep current versions of critical transactional applications.

- Maintain an inventory of everything, especially known pain points such as IT assets, vendors, customer contracts and regulatory requirements.

- Establish and pressure-test vis-à-vis scenario analysis key risk profiles such as security, international fraud and execution risk against the board-approved risk appetite and thresholds.

- Have tool sets and vendors for integration at the ready.

- Establish an overall risk appetite with key risk indicators in areas such as turnover, compliance violations, customer retention and synergy goal achievement.

Be mindful that governance, resourcing and the current state of scalability are root-cause issues that make or break integrations. The recovery of the oil and gas sector is welcome news to those organizations that are prepared — for others, addressing these three areas may help avoid a dry well in deal-making. Capturing your processes, checklists and templates in a playbook will pay huge benefits when you get the call to mobilize.