With the initial deadline for adherence to the Current Expected Credit Loss (CECL) accounting standard approaching, regulators and industry representatives gathered in New York recently for the CECL 2019 conference to discuss the top-of-mind considerations for CECL and understand what public, SEC-filing institutions should be doing to prepare to go live with the standard on January 1, 2020. One topic that stimulated substantial discussion was the qualitative factors play in estimating the appropriate reserves under the new CECL methodology.

According to the Federal Reserve Board’s FAQ on CECL, the new standard acknowledges that historical experience may not fully reflect an institution’s expectations about the future, and so institutions should supplement historical loss information with qualitative information as necessary to reflect the current conditions and produce reasonable and supportable forecasts that may not be reflected in the historical loss information.

Regulators believe the nine qualitative or environmental factors listed below will continue to be relevant under CECL and should be considered under the new credit losses standard. These factors are:

- Lending policy procedures

- Economic and business conditions

- Nature and volume of loans

- Lending staff

- Problem loan trends

- Loan review quality

- Collateral value

- Credit concentrations

- Competition, legal and regulatory environment

Key Considerations in Applying Qualitative Factors

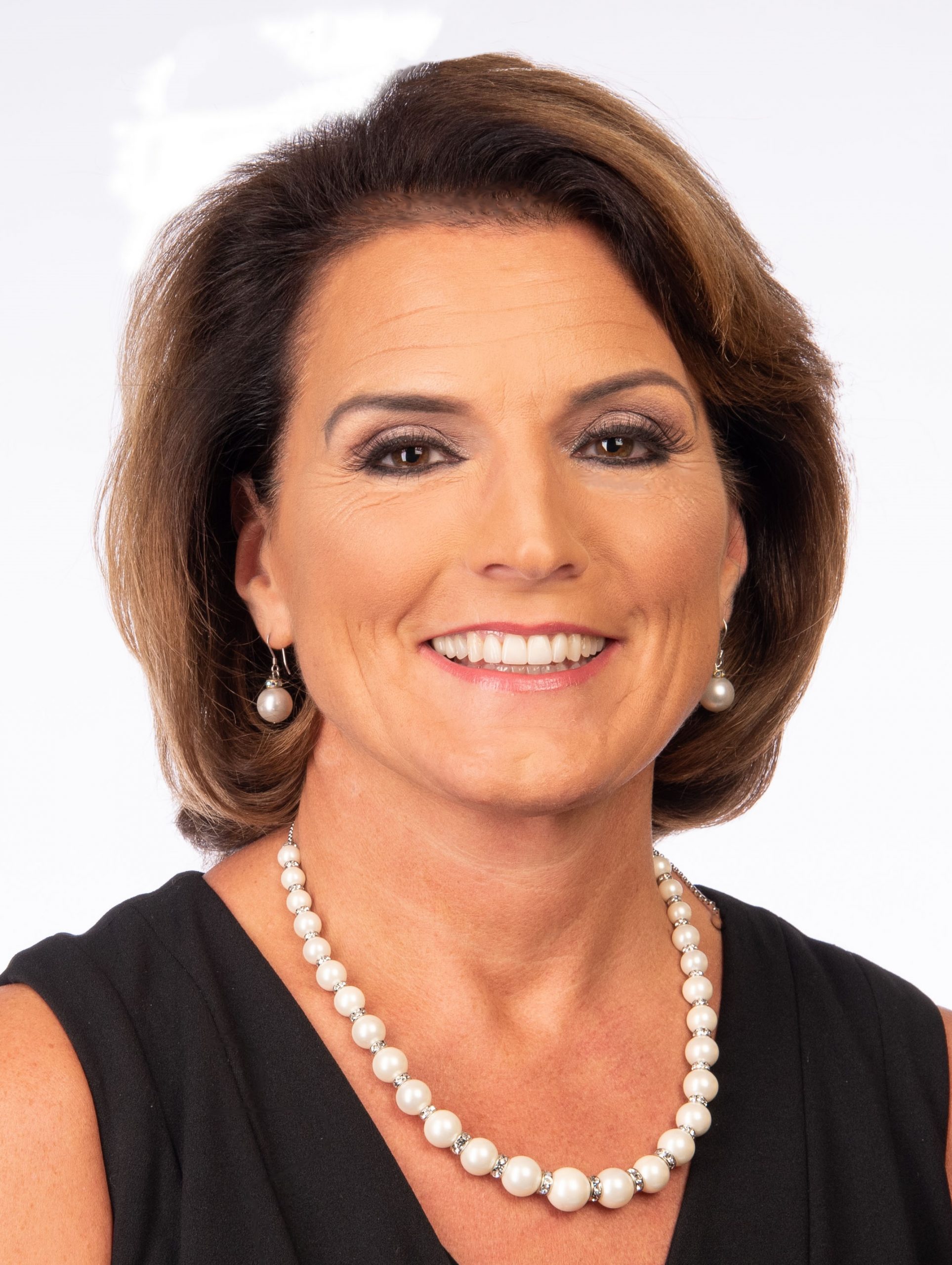

I had the privilege to join a panel of industry experts at the CECL conference to discuss some key considerations when incorporating qualitative factors into the overall CECL framework. They include:

- Changes in the size of the qualitative reserve. Many expected the size of the qualitative reserve to decrease under CECL but results from initial parallel runs for some banks have indicated the opposite. The increase in qualitative reserve seems to be largely driven by uncertainty and depends on the quantitative approach chosen for forecasting life of loan losses. The initial thinking was that the quantitative reserve under CECL would increase compared to the incurred loss approach, and the qualitative reserve would decrease as certain qualitative factors were expected to be incorporated in the quantitative forecast – but that has proven not to be the case for all banks. It’s recommended that model validators analyze the underlying causes of a potential increase for each component and provide effective challenge before full acceptance of the decision to increase or decrease the reserve.

- Modeling imprecision. Naturally, there is greater model risk present under CECL due to the increase in models involved in the estimation process. Management of this risk comes down to having model performance measurement and monitoring mechanisms in place and making adjustments where needed. Panelists were uncertain whether or not there should be a qualitative adjustment for the impact of modeling imprecision if uncertainty about future conditions has already been incorporated into the quantitative forecast.

- Double-counting factors. As noted above, several of the qualitative factors mentioned in the CECL standard and interagency regulatory guidance are likely to be already captured within quantitative models. Companies are accounting for this in various ways that are institution-specific; however, the key to avoiding double-counting is developing a structured process to demonstrate how each qualitative factor was considered and documenting the process for transparency and ease of replicability. The goal is to provide key stakeholders such as external auditors, regulators and model validators the ability to understand the decision-making process around qualitative factors so they can effectively challenge and replicate the qualitative reserve results.

- Stakeholder awareness and education. Many key stakeholders still conceptualize the credit loss allowance in terms of the “incurred loss” approach. Changing this mindset is crucial for a successful transition to CECL so stakeholders can understand the magnitude and drivers of change in the respective quantitative and qualitative components as well as how they are combined to arrive at the total CECL reserve. It’s recommended that CECL program owners speak regularly (at least monthly) with external auditors (to the extent appropriate), advisors and regulators to work through anticipated changes and conduct internal dry runs (at least quarterly) of the CECL allowance process to uncover internal stakeholder misconceptions, ensure that adequate process and disclosure documentation exists and reduce the risk of material misstatement in the financial statements. Institutions should also begin socializing and discussing the changes under CECL with investors as soon as possible.

The qualitative adjustment process is a key part of the loss reserving framework under CECL and should be validated based on CECL accounting guidance and regulatory model risk management principles. By taking the above considerations into account early in the CECL transition, institutions can mitigate the risks and challenges and ensure a successful CECL implementation.

For insights related to regulatory compliance, training resources and recent developments, visit Protiviti.com/regulatory-compliance. Also, read additional posts on The Protiviti View related to CECL.