With a December 31st deadline looming for SEC reporting financial institutions under the Financial Accounting Standards Board’s (FASB) new Accounting Standard Update (ASU) on Current Expected Credit Loss (CECL), institutions are in various stages of finalizing their models and model documentation, performing model validation and testing, performing parallel runs and updating processes and procedures.

CECL is a complex and detailed accounting update. The path to implementation began for public filers over two years ago. Interpretive refinements of the ASU are expected to continue into 2020. Protiviti recently conducted a webinar to help organizations benchmark their progress against industry best practices and become better-equipped to comply with CECL guidance. The complete webinar is available on our website, but we wanted to share some highlights.

Background

After the financial crisis of 2007-2008, the FASB decided to change the way banks calculate their allowances for loan and lease losses (ALLL). Under current accounting guidance, banks reserve for loans using an incurred loss framework to determine losses that are probable or identified as impaired as of a balance sheet date. The incurred loss approach for estimating probable losess primarily relies on historical loss trends and varying loss emergence period assumptions depending on loan type. Under the new CECL framework, financial institutions will be required to use historical information, along with current conditions and forecasts, to estimate expected loss over the life of the loans.

Considerations

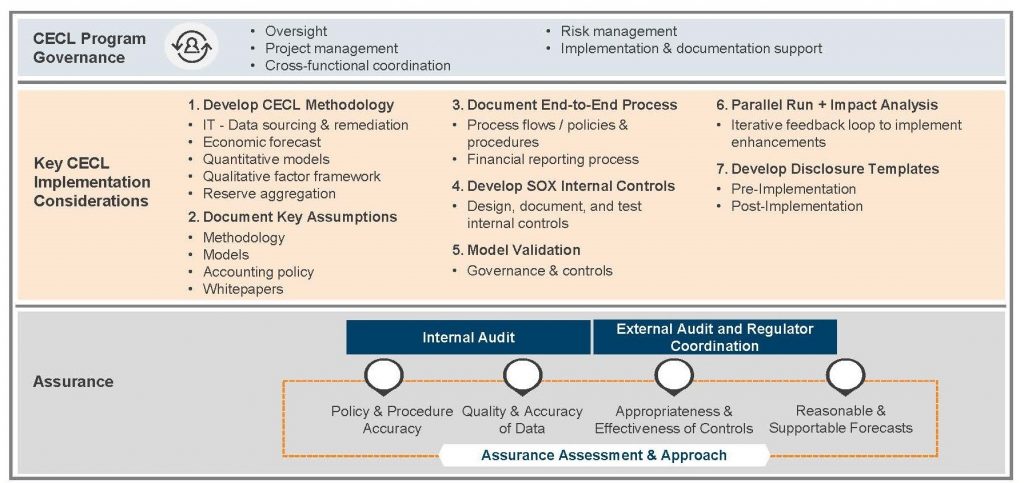

One of the biggest challenges in an undertaking a change of this magnitude can be knowing where to start. The following implementation model we presented at the webinar offers a good framework.

At the top, there is governance – the decisions involving who will oversee the effort, project management, cross-functional coordination, risk management, implementation and documentation.

After that comes implementation – identifying data sources and developing a model, documenting assumptions and processes, establishing controls, validating both the model and controls, running the model in parallel with the old model and analyzing the results, and developing reporting templates for required disclosures.

The parallel run is a critical success factor, providing institutions with concurrent estimates using both the old and new loss estimation models. The estimates are then analyzed for logic errors and for understanding the drivers of difference in the estimates. The parallel run provides a clear picture of the impact of the new CECL approach. Additionally, model validation is an important control and risk management tool to assess the soundness of the methodology andability to rely on the quantitative output of the model to ensure that it is fit for use, effective and sustainable

And finally, there is assurance, which involves engaging the three lines of defense to assess the accuracy of policies and procedures, the quality and accuracy of data, the appropriateness and efficacy of controls, and the reasonability of credit loss forecasts, working backward from output, to calculations, to underlying data.

Extra attention needs to be paid to the key assumptions. They need to tell a story that is reflective of the risk attributes of underlying assets and should be well documented for both quality control and transparency.

Challenges

Data lineage and quality were the top challenges cited by webinar participants. That is especially the case where there have been several mergers or system changes over the last few years. Also, often the rationale for key assumptions and modeling choices under CECL is not well documented.

Based on the experience of banks further along in the process, however, the real challenge is likely to be interpreting the results of the parallel run, because drilling down to the “why” in data analysis and determining the reasonability of a forecast is often more difficult than the mechanics of gathering the data and building a model. Decision makers will won’t to understand the “why.”

Validation

Aggressive implementation schedules may require model validation teams and internal audit to begin work before model development and implementation are completed. To maintain the independence and integrity of the CECL model validation process, it is important to use structurally independent teams and reporting structures, maintaining a clear separation between development and validation. Anyone who will be involved in validating the model should not have had any role in model development.

Model users and owners are the first line of defense, responsible for the quality, accuracy and completeness of the model. The role of the second line, i.e., the model risk management team, should be to effectively challenge the data, models and process. And finally, the third line (internal audit/assurance) should be responsible for challenging the model validation work, testing internal controls and reporting, and evaluating process integrity.

One final note on validation: a robust CECL loss reserve estimate relies on quantitative models as well as qualitative factors. Qualitative factors might include, for example, the nature and volume of loans, qualifications of lending staff, economic and business conditions, and problem loan trends. It is important to have a well-documented qualitative framework that evidences a) consideration of each of the qualitative factors noted in the CECL and interagency regulatory guidance, as well as b) avoidance of double counting any of the factors. For instance, economic considerations may be captured in the quantitative model via the economic forecast over the life of loan and therefore may not need to be accounted for again separately in the qualitative factors. Alternatively, a bank may have specific portfolios that are sensitive to economic factors that differ from what is in the economic forecast of the quantitative model and these will need separate consideration in the qualitative framework

The qualitative framework needs to be in place on day one, part of the validation process and updated going forward as conditions change. Ensuring that both the quantitative and qualitative components of the CECL estimate are validated and the consolidated loss estimate is reasonable is key to an effective implementation.

We hope this answers some of the questions related to the implementation of the new CECL standard. For a more thorough understanding, we encourage you to watch the webinar in its entirety, as well as read our previous posts on the subject.