Located within the Department of Homeland Security, the Federal Emergency Management Agency (FEMA) is responsible for coordinating the federal government’s response to natural and manmade disasters. FEMA is charged with providing both immediate and long-term assistance to local and state governments as well as individuals. FEMA funds are traditionally a large source of federal government assistance to state and local governments and their subrecipients for emergency/disaster aid. Not-for-profit hospitals and other healthcare organizations providing care and services for COVID-19 patients may qualify for these funds. All FEMA awards are subject to audit by the U.S. Government Accountability Office (GAO) or their designated contractors, so begin the costing journey with the end in mind — a successful audit of allowable costs.

Critical Success Factors

The funding process will require thorough knowledge of the FEMA instructions and expectations, thoughtful documentation of COVID-19 efforts with associated cost identifications, and proper documentation sufficient to meet the government’s needs. After an emergency/disaster ends, there are prescriptive timelines for submitting applications, and response times are uncertain. In order to obtain and retain the available funds successfully, the following factors are essential:

- Retain contemporaneous notes of emergency/disaster activities.

- Understand costing systems, both organizational and FEMA-recognized.

- Comprehend and employ FEMA terms/language.

- Utilize a cross-disciplinary team (e.g., clinical, finance, legal, compliance, internal audit) throughout the process; and

- Recognize the need to account for multiple government payment streams and fee-for-service billings when applicable to get to net allowable cost, as audits will very likely be designed to detect and reject duplicate cost claims. For example, if a healthcare organization received non-FEMA public health services emergency funds, it must have solid processes in place to identify those covered costs and remove those amounts from the FEMA cost calculations.

Funding Process

State Requirement

In order to qualify for FEMA funds, there must be emergency declarations at both national and state levels. A presidential emergency declaration has already been issued for COVID-19 and, as of the week beginning April 13, 2020, all 50 states have applied for and have been approved as emergency/disaster areas for COVID-19.

Once a state declaration is issued, funding may potentially be provided to cover the costs of efforts specific to COVID-19 from the effective date of the disaster to the yet-to-be-determined end date. FEMA funding is typically provided at 75% of the allowed costs and paid after the end of the emergency/disaster period. All applicable funding applications are subject to government review and audit for allowability of costs claimed, including supporting documentation. On occasion, the federal government will provide additional funding above the initial level and may authorize up to 100% reimbursement of allowed costs.

Eligibility

An organization seeking funding must be tax exempt under Sections 501(c), (d) or (e) of the Internal Revenue Code of 1954 or provide satisfactory evidence that the organization is a nonprofit organized to do business under state law. Private nonprofit facilities that do not provide critical services must apply to the Small Business Administration (SBA) for disaster loans and either (1) be determined ineligible for such a loan or (2) have obtained such a loan in the maximum amount for which the SBA determines the facility is eligible.

Allowable Costs

Applicants must identify, quantify and document COVID-19 reimbursable costs throughout the emergency/disaster period. Costs can include any activities in which some time and/or effort is absolutely necessary for COVID-19 treatment (e.g., clinical workflows, purchasing processes, materials/supplies); however, these activities often are mixed in with business as usual, resulting in a blended cost pool. Costs associated with COVID-19 must be clearly identified using accepted costing principles to avoid duplicating any billed patient revenue through typical fee-for-service reimbursement or billing for any non-COVID-19 related expenses.

As an example, it can be helpful to work with vendors to ensure that any COVID-19 expenses are clearly documented or articulated in invoices received from the vendor. Many organizations find that during these difficult times there are advantages to working with trusted business advisers to share insights and establish best practices to support the complete capture and appropriate documentation for all claimed expenses related to COVID-19.

All requested costs will be subject to governmental review and audit and are often significantly reduced if proper language and documentation are not available or provided. Notably, auditors will typically have their own detailed set of procedures and requirements for documentation.

Application Process

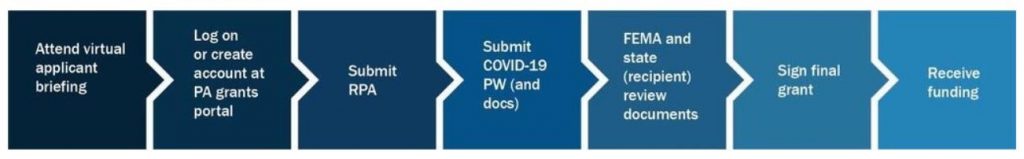

Reimbursement for efforts pertaining to COVID-19 falls under FEMA’s Category B: Emergency Protective Measures. The process and requirements for Category B are prescriptive and must be understood as the healthcare organization prepares cost claims. All data and documentation will be uploaded through the Public Assistance Grants Portal and requires specific formatting to fit within limitations. The application instructions are exhaustive, and FEMA will expect applicants to understand and follow the requirements. An overview of the process is outlined below, and more details can be found here.

Other Considerations

No Duplication of Amounts Claimed/Paid

The federal government will not allow duplicated cost claims or redundant payment for the same activity. This may sound straightforward but can be difficult to comply with unless there is a clear understanding of all government funding sources being pursued, and the cost that is included in each of those payments is not associated with claims/payments from another government funding source. The relevant audit oversight will be performed by the GAO for FEMA and the Office of Inspector General (OIG) for the Public Health and Social Services Emergency Fund (PHSSEF).