The far-reaching impact of the COVID-19 pandemic has resulted in great economic uncertainty for numerous organizations around the globe. In earlier blogs in this series, we have talked about the importance of continuing to execute and document the evidence of internal control activities, even if the activities or evidence looks different than in the past. Companies should also be assessing whether the materiality thresholds and levels of precision may need to be adjusted in order to adequately address changes to the business as well as the corresponding risk.

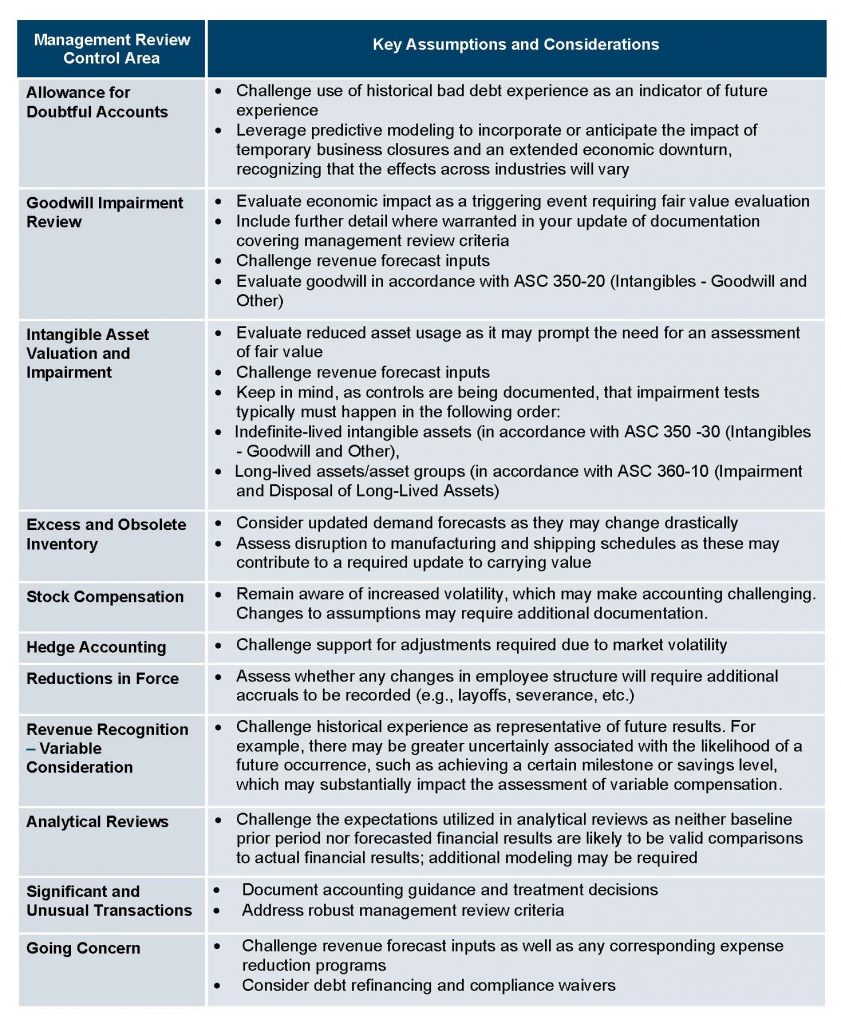

Specifically, COVID-19 will require companies to dust off significant and unusual transactions controls and controls over areas where the pandemic becomes a triggering event, requiring additional attention to asset valuation, the business’s ability to continue as a going concern and compliance with debt covenants. The current economic uncertainty will require companies to reassess their accounting judgments and estimates and, in turn, their impact on management review controls. Key assumptions and inputs will be subject to additional scrutiny, and robust documentation of management review criteria will be required.

Additionally, internal and external auditors will be expecting management to assess potential COVID-19 impacts on the control environment, including management review controls. They will also be looking at how these controls are operating during this period of uncertainty. Those in a SOX compliance role must evaluate how the key assumptions in the management review control areas were changed, reviewed and approved for FY20. We list some of these areas and assumptions in the table below.

Consider following the steps outlined below as you prepare your control documentation:

1. Identify Key Assumptions – This fiscal year many underlying assumptions will need to be revisited and even the population of key assumptions will need to be confirmed and potentially adjusted or expanded. Calculation inputs that were considered standard may now need to be revisited and considered key assumptions. It is also important to note that not every input needs to be considered key and subject to the same assessment. Identify which assumptions are key and identify what amount of change in the assumption (i.e., x percent) would impact the output by more than a certain amount (i.e., $xx).

2. Challenge Key Assumptions – Once the subset of key assumptions has been refreshed, management must address areas and accounts where key assumptions may be more difficult to compile and evaluate in uncertain times. Organizations are trying to revise forecasts in an environment that is unique, and different for each organization. Therefore, the judgments and estimates made will most likely need to continue to be reassessed throughout FY20. Documenting how companies evaluate contradictory evidence will also be more important than ever.

The following table outlines some specific assumption considerations and challenges for several areas typically requiring management review controls:

3. Increase Level of Detail of Analyses – More detailed evaluation will likely be required in FY20 than was necessary during the last several years of strong economic prosperity. For example, a step 0 or qualitative assessment may not be enough and further analysis and evaluation steps may need to be taken. The PCAOB has revised audit standards on auditing accounting estimates, including fair value measurements for fiscal years ending on or after December 15, 2020 (now AS 2501 – Auditing Accounting Estimates) so management will also likely feel the follow-on effects of these additional requirements from external audit.

4. Consult with Specialists – More detailed evaluations may also result in management needing to consult with specialists in new areas where external validation of management’s assumptions and models was not required in the past. The PCAOB is also revising the standards for specialist use, so it is more important than ever for management to challenge and approve the specialists’ work.

5. Evaluate Any New Controls – New temporary or permanent controls may need to be added with organizational changes, including remote working and facility closure. Management should consider whether these controls meet the criteria of management review controls and require the necessary additional documentation.

6. Coordinate With External Audit – As with all aspects of internal control over financial reporting, early and frequent communication with the external auditor on the impacts of the pandemic is recommended. Management should review and obtain external audit agreement with the updated execution and documentation of management review controls in FY20.

The longer adverse economic conditions persist, the more likely that write-downs or adjustments that occurred in Q1 will need to be revisited again. However, evaluating controls over these areas earlier in 2020 will help ensure quarterly financial statements are accurate and relieve some of the pressure on bandwidth in the second half of 2020.

Protiviti’s SOX Champions Network contributed to this content. For more blogs in this series, click here.