Major crises expose the true nature of things. In the face of extreme pressure, organizations discover just how digital, agile and resilient they really are. And their finance groups are no exception.

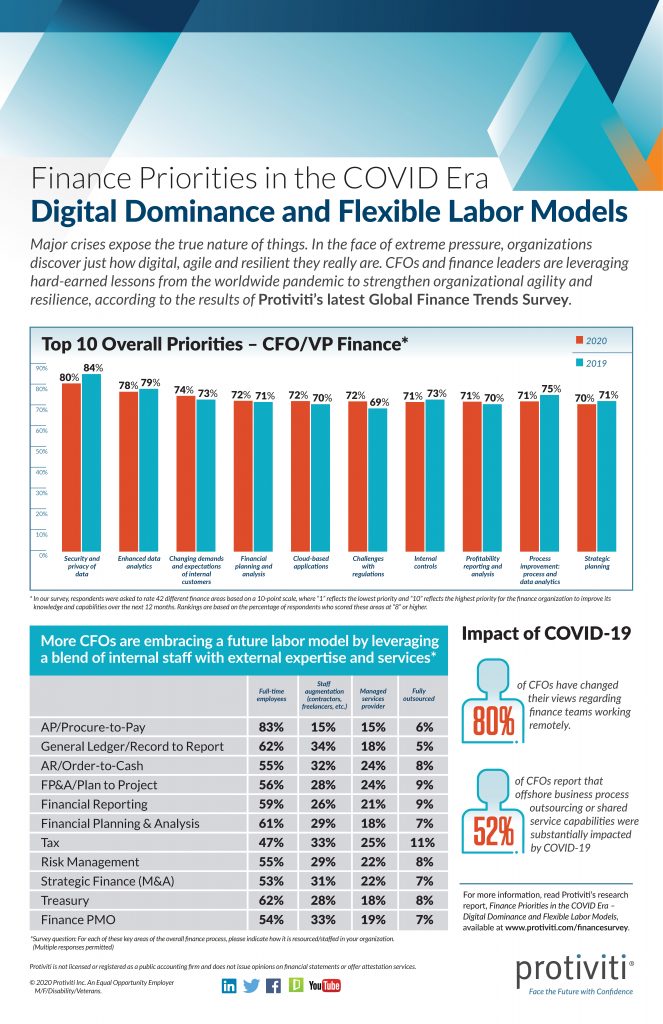

Protiviti has released the results of our latest Global Finance Trends Survey, which identify the top priorities for CFOs and finance leaders over the next 12 months. Our findings illuminate how COVID-19 is affecting finance operations, even while broader finance priorities and trends are largely consistent with prior years – from security and privacy of data, to meeting the growing demands of internal customers, to leveraging advanced data analytics.

Based on the top finance challenges and areas of focus revealed in our study, here are four habits that CFOs should ingrain into their jobs.

- Clarify your long-term cybersecurity role – Data security and privacy represents the top priority for CFOs and finance leaders to address over the next 12 months. Top-performing finance groups are integral enablers of organizational cybersecurity. They focus their finance expertise on how data security and privacy spending is benchmarked, how those investments are allocated, and how cyber risks are quantified in dollar amounts and articulated in business terms. Leading CFOs also are engaged with how the organization identifies and monitors its third party cybersecurity risks.

- Embrace the new level of accountability you’ve earned – CFOs have more than earned the credibility that accompanies their seat at the executive decision-making table. Now, they’re accountable for satisfying the demanding expectations of their colleagues at the table as well as those of a broad range of other internal customers, whose appetites for finance and performance insights have soared in recent years. The COVID-19 pandemic has only increased requests from the business for real-time data and analysis. Satisfying these expectations is more vital than ever at a time when internal customers – who now include real estate groups, human resources functions, IT, ESG, investor relations, supply chain, and many others – want more frequent, detailed and dynamic financial analyses and forecasts.

- Get the foundational enablers of digital finance in place – The sudden economic strains and massive shift to remote working models caused by COVID-19 cast a harsh but instructive light on the true state of digital transformation in the finance organization. By the second quarter of 2020, it was vividly clear whether finance groups were operating in a truly digital manner or making do with a digital veneer around their core finance capabilities. In our Global Finance Trends Survey, nine out of the top 10 CFO priorities relate to advanced technologies and digital transformation. The success of the latter hinges on the ability of finance leaders to support and advance the foundational elements of digital transformation – data quality and governance, analytics, workflows, collaboration and more – with sufficient attention, funding and improvements.

- Right-size your finance labor model for the future – In addition to demonstrating digital leadership, finance groups successfully navigating the global pandemic and the “new normal” are more likely to employ a flexible finance labor model. CFOs and finance leaders who deploy and, when necessary, recalibrate a varied portfolio of full-time employees, contractual and temporary workers, expert external consultants, and managed services and outsourced providers are able to operate with greater flexibility and agility – an approach that has paid dividends during COVID-19’s vexing disruptions. This model also enables CFOs to ensure there are few, if any, compromises to their core finance and accounting processes.

Interested in learning more? Find further insights and our full report, Finance Priorities in the COVID Era: Digital Dominance and Flexible Labor Models, at www.protiviti.com/financesurvey.