Today’s economy is driven by talent, knowledge and innovation, precisely the factors created by human, rather than solely physical, capital. As a basis for making investment decisions, stakeholders have wanted more visibility into how organizations derive value from their workforce. How companies acquire and retain people – and how they deploy human capital to create value – speaks volumes about the quality of a company’s leadership, values and prospects.

In August 2020, the U.S. Securities and Exchange Commission (SEC) issued a rule that requires companies to report on human capital metrics. The rule became effective in November of 2020. This amendment to SEC Regulation S-K Item 101(c)(1)(xiii) requires human capital disclosures “to the extent such disclosure is material to an understanding of the registrant’s business taken as a whole.” The new requirement is designed to modernize financial reporting by adding an element that is being increasingly scrutinized by investors, customers, shareholders and employees, and now, regulators.

Some annual reports have already been filed, with more coming every day. The bulk of reporting will take place as calendar-year companies file year-end reports in the coming weeks.

The language of the new rule grants companies latitude to shape the content and format of their human capital reporting. The application of the regulation will likely become more definitive over time but meanwhile, as companies evaluate one another’s human capital reports, we expect a common style may organically emerge. Some organizations will take the opportunity to showcase unique and innovative ways in which they leverage their people investments.

As publicly traded companies make their initial reports, variation in reporting styles will likely be driven by business’ distinguishing characteristics – such as verticals, stakeholders and geographies. Other variations will result from the spirit in which different organizations approach human capital reporting. Some may see it as a check-the-box exercise. But others will want to derive benefits from using human capital reporting meaningfully: to establish direct links between their people and their future prosperity.

With few specifics in the new regulation, how can companies articulate the relationship between workers and the company’s value? Assuming leaders want to go beyond checking the box and derive meaningful value, the following steps will help them get the most out of human capital reporting as a discipline.

- Identify important human capital metrics. Because the SEC has provided limited formal guidelines, companies can start with the measures they value most while anticipating the information requirements of their stakeholders. It is useful for companies to think of measures in tiers or levels. Practically, most organizations start with Tier 1 demographic measures such as headcount, age, length-of-service, job roles, etc. The next tier includes operational measures, which are related to the success of HR in recruiting, developing and retaining employees as well as the success of the company in managing its workers. Tier 3 measures focus on outcomes – such as absence, retention, engagement levels and customer experience scores. Lastly, the fourth tier focuses on linkages – for example, between engagement and performance. As the nature and substance of human capital reporting evolves, companies may find value in moving through the successive tiers as they assess and describe their businesses.

- Develop the measurement approach. Human capital reporting requirements create a new class of information for SEC reporting. A considered approach first involves measurements and outcomes, which is the bigger picture framework, followed by the metrics that support the framework. As with financial data, content must be factual and verifiable. Companies will want to establish practices around what gets measured and how it’s collected, verified and presented. Begin with the end in mind: Have a clear vision for what the human capital report will contain, then build processes to gather and verify supporting data.

- Quantify the return on investment for talent (ROIT). Human capital reporting introduces an opportunity for companies to differentiate and to influence employees, customers, investors and other stakeholders. Businesses can use human capital reporting to advance a narrative about meaningful human capital programs and initiatives as a demonstration of corporate values and as a competitive differentiator.

- Prepare the scorecard. A human capital reporting scorecard will convey a message to external stakeholders, but it’s also a device for managing and driving internal outcomes. Scorecard design includes not only content and format considerations, but also a complete data plan to gather facts from information systems and provide traceability back to sources. As the scorecard evolves, developing an approach to automating sources of input and data will become a necessity; otherwise, scorecard preparation, rather than analysis of the scorecard data and managing the necessary change, will consume more than an ideal amount of time.

- Monitor and manage with senior leadership. While human capital disclosures are intended for an external audience, namely investors or potential investors, a human capital reporting strategy also involves scorecards and analysis for internal reporting purposes to drive the intended outcomes. The metrics identified for internal human capital reporting can be a basis for management objectives related to leading teams and reaching human capital goals. The format and packaging of reporting should consider the audience. Boards and senior leaders prefer summaries and scorecards with trends and benchmarking, whereas team and divisional managers prefer more detail and drill down into areas and across teams. Approached comprehensively across all areas of leadership, the human capital scorecard can support and inform executive decisions all year. Not only will the organization derive full value from routine internal use of scorecards, but a practice of constant review will also prevent surprises at year-end.

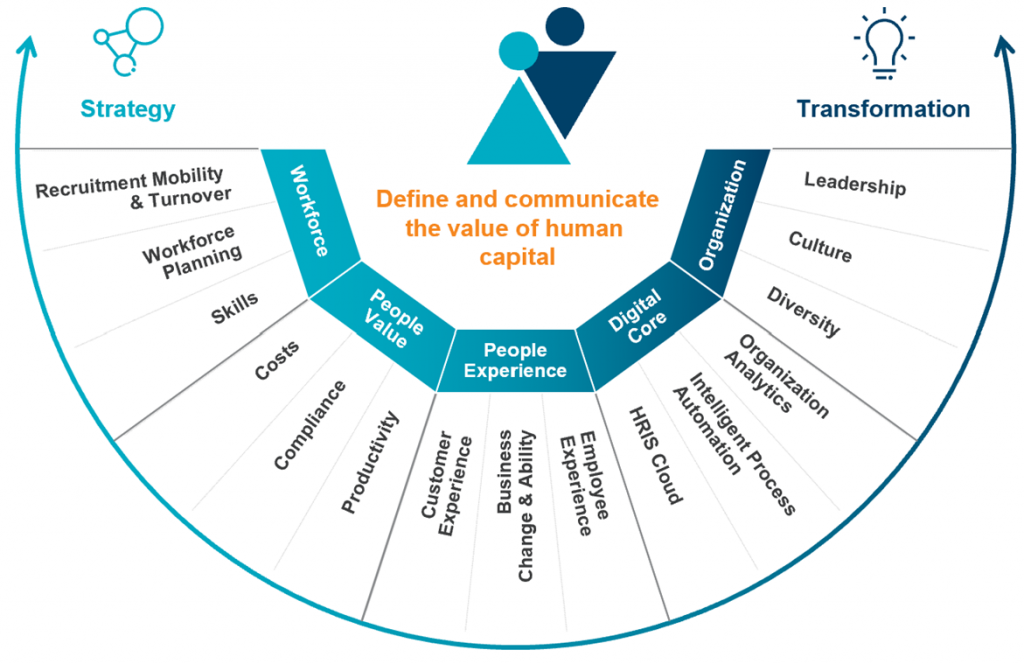

- Create the human capital report to support regulatory requirements. In 2018, the International Standards Organization (ISO) published ISO 30414, “Guidelines for Internal and External Human Capital Reporting.” The SEC has not mandated adherence to this standard but at Protiviti, we believe that a human capital reporting framework that starts with ISO 30414 as its foundation is valuable, and have created a model. The Protiviti framework includes five core dimensions to consider, organized by themes including workforce, people value, people experience, digital core and organization. Not all dimensions or subdimensions need be represented in any company’s initial report; instead, the framework helps shape reporting that’s aligned to the values and goals of the organization.

Protiviti’s Human Capital Reporting Framework

- Incorporate human capital metrics into quarterly earnings call preparation. The new SEC rule will increase the transparency of public disclosures. Senior leaders should be able to articulate the true value of their people in financial terms and definitively express the value of their workforce.

- Establish ongoing governance. With increasing emphasis on human capital reporting and investor interest, governance must start at the board level, which best represents investors. Boards will need to adopt a more comprehensive and strategic posture to provide effective oversight of the organization’s human capital asset. The right human capital reporting strategy will assist boards and senior leaders with the right metrics and analytics to support internal and external flows of information.

New human capital reporting requirements will bring investors information that’s been missing from annual reports of the past. The latitude the SEC has granted in both content and format creates opportunity for leaders who view human capital reporting as a way to differentiate their organizations, to earn loyalty from customers and employees and to monitor progress of their human capital programs. There’s much to be said about using human capital reporting to improve business results, and we’re looking forward to sharing more about that in future posts.