The objective of sustainable development is to extend the life expectancy of ecosystems, societies and economies through collaboration with other organizations — for profit and not-for-profit, in the private and public sectors, and across borders on a global scale. This means sustaining natural resources. It means sustaining the cultures and communities that enable commercial activity. And it means sustaining the governance structures and financial and other markets essential for corporate competition and viability.

Sustainable development has gained traction in the markets. Sustainable investments driven by the screening criteria of institutional investors and asset managers are on track to represent more than a third of the projected total assets under management by 2025. No doubt, energy producers are generating a substantial portion of global industrial GHG emissions. But “non-energy companies,” e.g., companies other than oil and gas and power companies, are not getting a pass. The message is clear: The conversation merits attention in the C-suite and boardroom of every company, regardless of the industry.

The question is, what does an organization do now and how does it do it? Every company needs to answer this question based on the nature of its industry, culture, markets, stakeholder priorities, regulatory environment, appetite to lead and invest, intrinsic challenges from an execution standpoint, and long-term outlook. With that in mind, below is an approach for management to consider:

- Articulate sustainability guiding principles and core values. Clarify directionally what the company wants to accomplish from a sustainability standpoint to drive strategy setting and internal and external communications.

- Assess current ESG performance. Identify areas where management sees the most opportunity for impact. This determination entails a materiality assessment to drive the areas of focus and metrics to track.

- Evaluate opportunities and risks. Considering the organization’s current ESG performance, assess the upside of taking steps to improve it against the risks associated with inaction.

- Assess the organization’s sustainability infrastructure. Understand and evaluate the effectiveness of the current policies, processes, organization structure, reporting, methodologies and systems supporting the pursuit of sustainability objectives.

- Formulate a sustainability strategy. Based on the guiding principles and core values and the assessment of opportunities, risks and current sustainability infrastructure, define a road map of key initiatives for accomplishing sustainability objectives. Formulate the strategy to execute the initiatives set forth in the road map.

- Set accountability for results. Establish targets, assign executive sponsorship, define initiative ownership, and specify the appropriate performance metrics. Integrate ESG performance monitoring with financial and operational performance monitoring and the reward system.

- Integrate with the CEO dashboard. Incorporate metrics in the reporting to the C-suite to ensure initiatives gain traction.

- Establish disclosure controls and procedures. Establish the appropriate controls and procedures to ensure reliable internal and external ESG reporting.

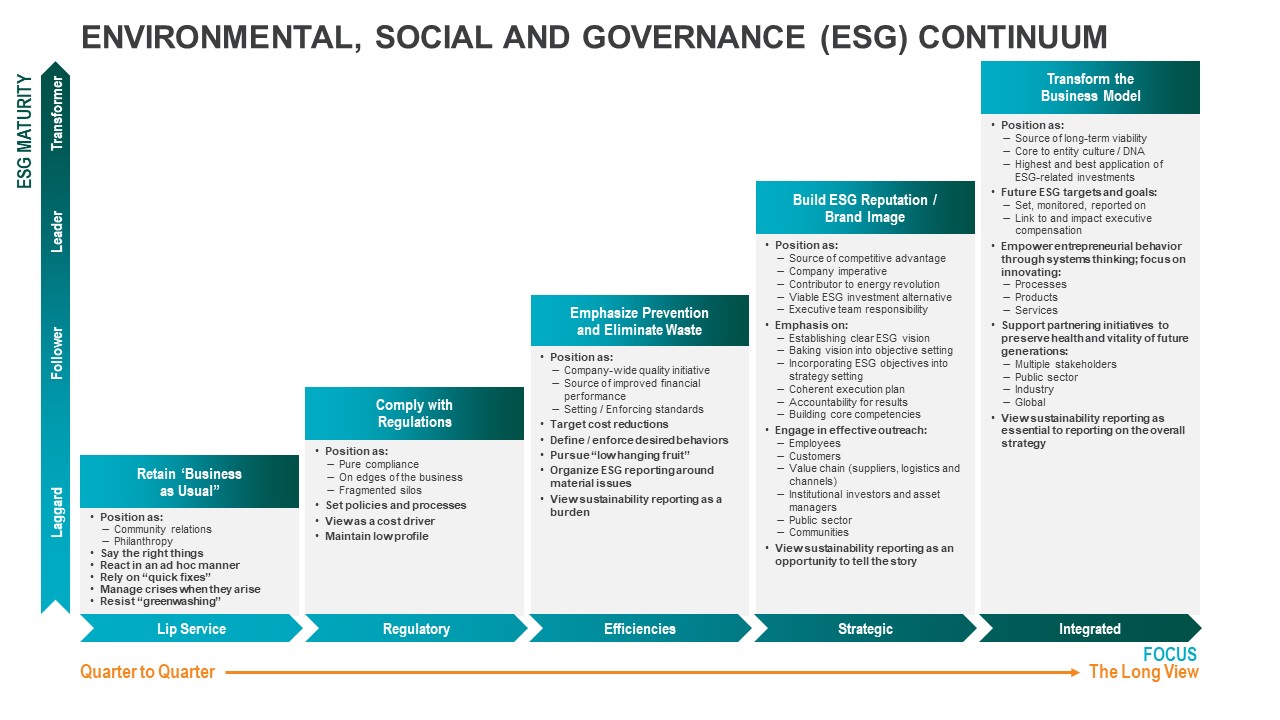

Every organization is different. Accordingly, management and the board must decide the ESG maturity at which the organization should operate. The following continuum illustrates alternative stages of maturity depending on management’s focus:

Today, engaging in lip service to say the right things and focus primarily on philanthropy and community relations seems way behind the realities of the times. Smoke and mirrors don’t work anymore, and companies playing with a weak hand may be tempted to “greenwash.” That could be dangerous as investors and other external stakeholders are much more educated in spotting the fluff as they look for the substance. For companies listed on U.S. exchanges, the Securities and Exchange Commission is monitoring for abuses in ESG reporting. Bottom line, laggards who don’t walk the talk eventually get exposed and pay the price of reputation loss and brand erosion.

Regulatory compliance is a positive development but is driven more from the risk perspective and leads to a follower positioning from a sustainability standpoint. Companies operating in this mode had best keep their eye on their competitors and pay attention to the BlackRocks and Vanguards of the world. For many organizations, regulatory posture may be the baseline or foundation on which they can start to build their strategy for success.

Efficiencies is a higher level of focus that advances the organization toward a leadership position. A focus on improving the cost-effectiveness of internal processes is a logical step because it results in improved profitability. For example, computer manufacturers integrate alternative, recycled and recyclable materials into their product and packaging design, which reduces waste and operating costs. This is a solid efficiency play. However, an exclusive focus on operational efficiency objectives is not equivalent to a strategic approach to the market and will ultimately fall short of ever-rising market expectations.

The aforementioned computer manufacturers progress to a more strategic approach when, in addition to improving the energy efficiency of their processes, they offer services to help customers compute more while consuming less energy and design products for end-of-life and recyclability. As a result of investing to enable customers to meet environmental, operational and financial goals, they advance their sustainability positioning to a leadership role by raising the table stakes for playing in the industry. This positioning is achieved by incorporating environmental and social objectives into strategy-setting, in addition to financial objectives.

Finally, there is the rarefied air of the integrated stage that leads to transforming the business model. An integrated approach of embedding sustainability into strategy and product development to establish a sustainable business model inevitably requires new talent, deploys new technologies and coalesces sustainability and strategy to create the breakthrough innovations that sustain the business and maximize ESG and financial performance. A transformative approach to sustainability is a source of long-term viability, particularly if it offers technologies and services that address some of the world’s sustainable development challenges. Thus, the way the organization conducts business today carries with it a long view toward sustaining its future success, reputation and brand equity.

This discussion is strictly illustrative of the different stages along the ESG continuum. There are other ways to express sustainability maturity. The one we depict above is just one way. In practice, the continuum must be customized by industry sector. The key point not to be missed is how the company should answer the following relevant question: Where does the organization want to be on the ESG continuum and why?