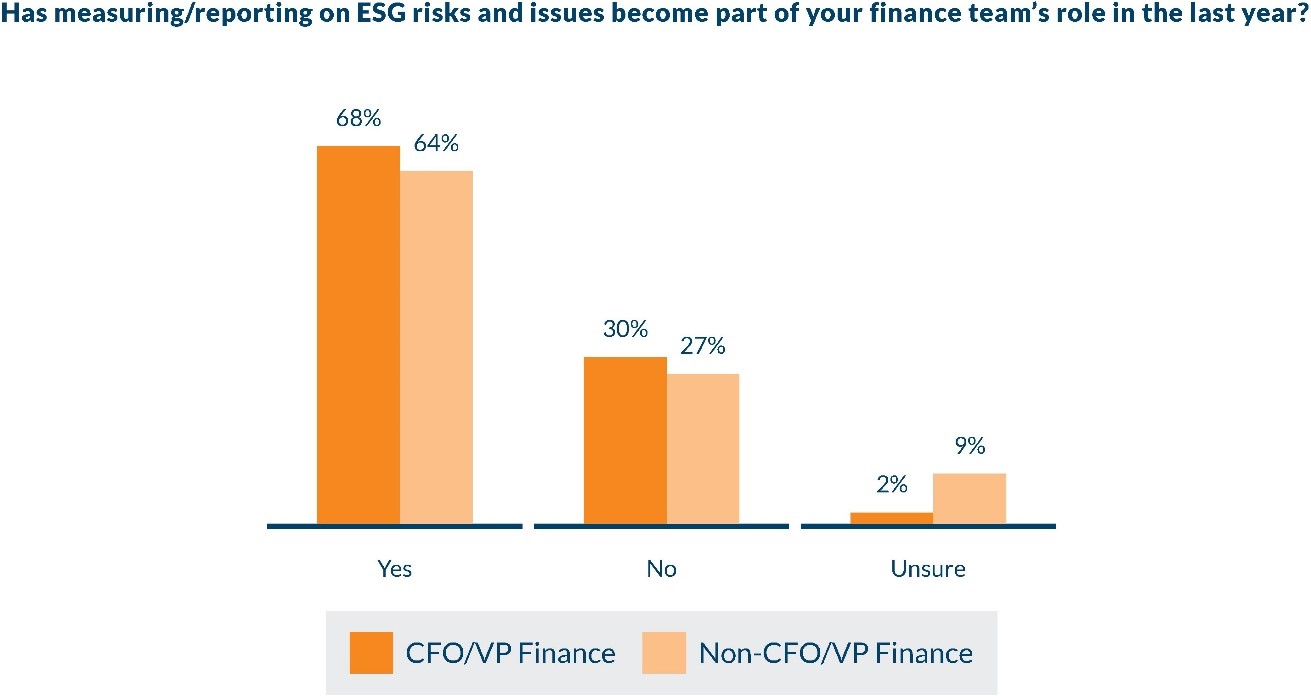

CFOs and finance leaders are focusing more time, expertise and innovation on their organization’s environmental, social and governance (ESG) and Human Capital investments and reporting. Not only do ESG and Human Capital metrics and measurement rank among the higher priorities for CFOs and finance leaders, according to Protiviti’s latest global survey of CFOs and finance leaders, but these areas also are considered among the top priorities to address if these executives had to select just one area on which to focus. While this is not a novel perspective, it is newly pressing given the groundswell of regulatory actions, social attention and climate risks that have recently materialized.

CFOs should recognize that ESG and Human Capital reporting present an opportunity for companies to share what they are doing to sustain long-term value creation aligned with the interests of shareholders, while also addressing the interests of customers, employees, suppliers and the communities in which they operate. In particular, given the when-not-if nature of looming SEC ESG disclosure requirements, many CFOs are working closely with investor relations, legal, compliance and sustainability partners to transform their ESG and Human Capital reporting data into relevant metrics. This work typically involves:

- Refining the data collection process: Initial data gathering for ESG and Human Capital reporting and disclosures typically involves scores of emails and a heavy reliance on spreadsheets as a summary tool. No finance group will want to repeat that ad hoc data gathering process every quarter, so it is important to begin identifying better and more advanced processes and technology tools as soon as possible. The purpose of these improvements is to ensure the accuracy, efficacy, consistency and efficiency of all ESG and Human Capital data gathering activities moving forward.

- Making use of existing historical data: Plenty of environmental and Human Capital data resides in past financial This data often can be repurposed to produce formal ESG and Human Capital metrics in line with standard reporting frameworks. Employee turnover and logistics activities are good examples of historical data that are mined for ESG and Human Capital reporting use.

- Educating producers of ESG and Human Capital data on the need for rigorous controls: As finance teams obtain Human Capital and ESG data from business colleagues and third parties, they should keep in mind that few, if any, of these partners are familiar with the exacting controls financial reporting requires, much less the importance of materiality considerations and consistency of presentation. These collaborators will need to be educated in producing ESG and Human Capital data of the same quality, and at the same cadence, as financial data.

- Planning for resource shortages: Given the number of new stakeholders involved and the amount of manual legwork required, initial data gathering activities for ESG and Human Capital disclosures will require significant time and personnel during a period when the finance group’s priority lists — from the manager level up to the CFO — are overflowing.

- Getting to an “audit-ready” state: Companies active in the capital markets know that anything in a public filing is fair game for a “comfort letter” request from an underwriter. The best way to ensure the validity, accuracy and applicability of ESG, climate and Human Capital data is to remember that an auditor ultimately will need to confirm that the data is just as reliable as the financial data they are accustomed to reviewing.

Interested in learning more? Further insights and our full report, Security, Data, Analytics, Automation, Flexible Work Models and ESG Define Finance Priorities, are available at Protiviti.com/FinanceSurvey.