As companies come under growing pressure to make measurable, reportable (and reported) progress on environmental, social and governance (ESG) issues, there is increased demand on business leaders to implement effective sustainability practices that resonate with customers, partners and employees. Technology, media and telecommunications (TMT) companies have not been immune to the pressure.

Although TMT industry leaders who responded to Protiviti’s 2022 Top Risk Survey do not specifically identify ESG concerns as a particular point of risk, ESG considerations permeate many of the top risk issues discussed in the survey, including succession concerns, the challenge of upskilling or reskilling employees to meet today’s digital technology demands, and the importance of reshaping an organization’s culture to succeed in a post-pandemic period. These considerations, therefore, are driving key business decisions that TMT leaders are making to enhance their competitive advantage.

The ESG journey

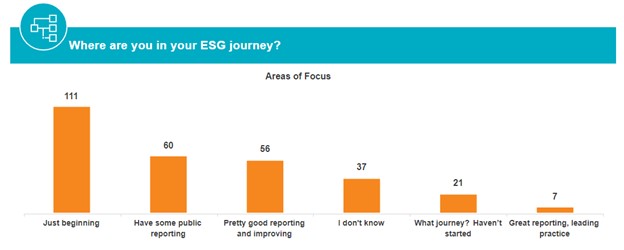

The ESG journey is just beginning for many organizations, including TMT companies. For example, during a Protiviti webinar with technology leaders earlier this year, nearly 40% of participants acknowledged that they are just beginning their ESG journey, 20% stated that they are already issuing public reporting on ESG, and 19% responded that their ESG reporting is pretty good and improving.

The competitive advantage (and imperative) of focusing on ESG is increasingly clear. Organizations with robust, well-structured ESG programs tend to be higher performing, with better compliance controls and stronger employee retention. The brand impact is significant and undeniable. Companies that leverage the power of social media to promote ESG or have established a strong ESG brand in the marketplace tend to have more loyal customers.

The largest tech companies clearly recognize the tremendous value. A few notable examples: Alphabet, Google’s parent company, is the world’s largest corporate purchaser of renewable energy; Salesforce has partnered with One Tree Planted to grow and conserve 500,000 native trees on Nazko First Nation territory in Canada; NVIDIA repurposed corporate kitchen facilities during remote work to prepare meals for needy families; Airbnb has a team of employees serving as ethics advisers tasked with helping employees interpret and understand its code of ethics; and Uber decided in 2020 not to charge delivery fees for orders from Black-owned restaurants.

On ESG reporting, maturity levels vary widely across the tech industry, but many companies are reporting steady progress. Some of the best performers in the industry have developed reporting frameworks that detail how specific ESG initiatives or efforts impact their organizations and, in several cases, are using a materiality matrix to rank the impact from medium too high to very high. Common material issues on which tech companies are reporting include data security and privacy for employees and customers, waste and energy use, employee engagement, and the supply chain.

Within individual organizations, there is disparity over who has primary responsibility for ESG reporting. Over time, we expect those differences to narrow and for the industry to show more consistency. During Protiviti’s ESG webinar for tech leaders earlier this year, about 33% of participants stated that reporting is the responsibility of an ESG committee or task force, while 11% assigned it to investor relations and 9% attributed accountability to their SEC reporting team. However, a high number of respondents mentioned they did not know who was responsible for ESG reporting in their enterprise.

Industry standards and trends

During the last two years, more companies have shifted from reporting on a single ESG framework to reporting on three or four in some cases. Recent analysis shows the Climate Disclosure Project (CDP) to be the leading framework for most companies, followed by the standards developed by the Sustainability Accounting Standards Board (SASB), the Global Reporting Initiative (GRI) and the Task Force on Climate-related Financial Disclosures (TCFD). The SASB standards — an industry-aligned scheme that focuses on 11 sectors and 77 industries — have gained significant market share in recent years and now constitute the preferred benchmarks for U.S. stock companies.

Still, because of the challenges that come with the utilization of multiple or disparate frameworks, there continues to be strong interest in creating a more simplified, standardized and consistent approach to ESG reporting. To that end, many are looking forward to the launch of the new International Sustainability Standards Board (ISSB), which is developing a comprehensive global baseline of sustainability disclosure standards.

ESG considerations for IPOs

ESG is not just for public companies. Whether seeking long-term financing, renewing commercial insurance or pursuing a public offering, private companies are increasingly asked to provide information about their sustainability practices. For private companies pursuing or contemplating a public offering, there are significant implications. Human capital reporting is now required, which means the SEC reporting team will need to take on the responsibility of gathering and providing this information. Of course, companies must also be prepared to disclose any material impact from climate change, per SEC rules going back 12 years, and may be in for more depending on the ultimate resolution of currently proposed new SEC rules. Many companies are now reporting climate change based on industry-specific SASB guidelines or the TCFD framework.

Finally, companies seeking to go public should pay close attention to provisional ESG ratings that investment solutions firm MSCI has developed. The ESG ratings are designed to measure how well a company manages its financially relevant ESG risks and opportunities, using a rules-based methodology to identify industry leaders and laggards. Rating metrics include climate change impact, diversity, inclusion, equity and business ethics. In the IPO context, pursuing an ESG rating is worth considering, as it can increase investor confidence, but companies should carefully weigh the implications on valuation if they are concerned that they may not meet ESG standards. For additional insights on how to prepare successfully for an IPO, read Protiviti’s Guide to Public Company Transformation.

Bottom line: It is time for all TMT companies to get started on the ESG journey to enhance their value, improve risk management practices and stay relevant to employees and customers.

Listen to this webinar for more insights on ESG trends and practices relevant to the TMT industry. Also, read additional blog posts on The Protiviti View related to ESG.

Bob Hirth, Protiviti Senior Managing Director and member of the PCAOB Standards and Emerging Issues Advisory Group (SEIAG), contributed to this content.