As businesses are increasingly being scrutinized by their employees, stockholders, customers and society at large, leaders are responding by taking visible stances and observable action on racial equity, LGBTQ+ rights and gender pay differences — and now, as news stories develop, on even more issues seemingly daily. In an age where news is immediate and opinions quickly shared, organizations’ views and behavior on sensitive issues have become broadly known. Leaders are addressing these ESG (environmental, social and governance) issues as reputational, brand and business risks.

In August, I had the opportunity to participate in a webinar about the future of ESG strategy and reporting. Joe Kornik, Editor-in-Chief of VISION by Protiviti, facilitated the conversation; sustainability strategist, speaker and author Andrew Winston joined us, as did Sharadiya Dasgupta, founding partner of Blue Dot Capital, and Stephanie Dolmat, Senior Director of ESG for Robert Half, Protiviti’s parent company.

Interest in ESG has spiked in recent years among a growing number of stakeholders, including industry and financial regulators, but the point of acceleration was when investors began asking how environmental and social issues affect businesses’ performance and bottom line, questioning whether businesses were sustainable and contributing to a sustainable society.

Fast-forward just a few years, and it would be difficult to find leaders of multinational businesses today who are resistant to the idea that ESG issues must be discussed, explored and addressed. Increasingly, large enterprises are setting aggressive, science-based goals to reduce carbon emissions, for instance. They are looking at climate data and seeing a clear line between extreme weather events and raw material and supply chain vulnerabilities, for example.

Many companies are finding the need to provide data and commentary about their ESG performance as they respond to customer and other stakeholder inquiries in pursuit of new (or continued) business or new employees. This is driving businesses that haven’t been considering ESG matters to respond in kind to remain competitive.

What the polls say

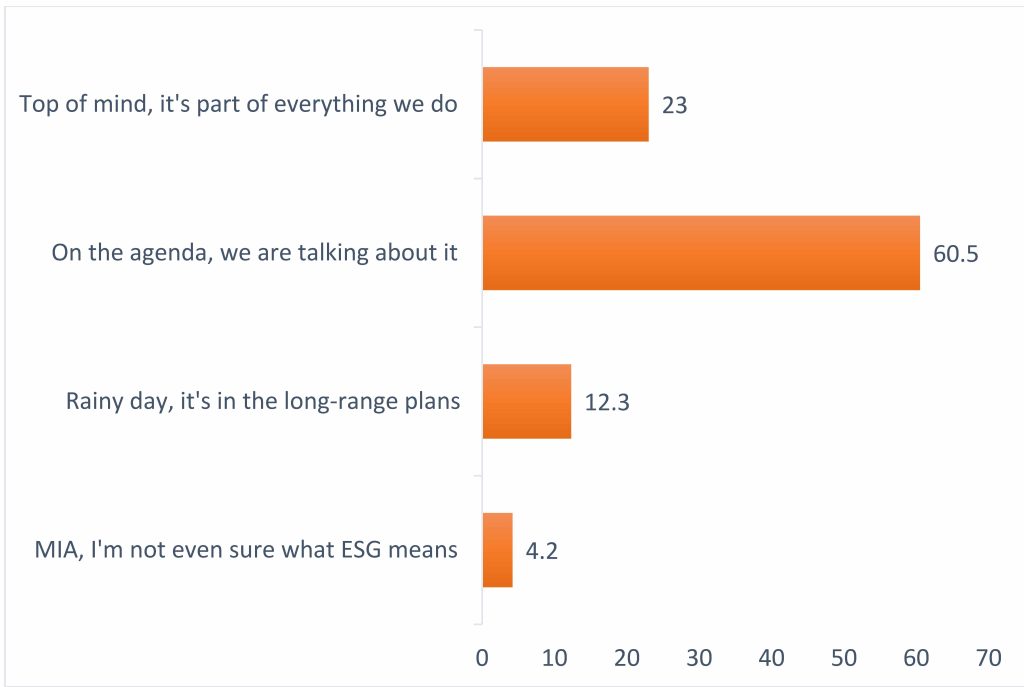

We were curious about the state of ESG among our webinar audience, so we asked: Where are companies on the ESG spectrum? We found that about 60% had ESG on their agendas, and almost a quarter of the others said it’s top of mind. 13% said it was part of a long-range plan, and a small minority were just learning what ESG means.

How would you summarize your company’s ESG initiatives as a strategic driver of sustainable business?

Moral and ethical decisions

ESG is about much more than meeting emerging compliance requirements and responding to stakeholder data requests. It is about how companies are run; the moral and ethical decisions being made by businesses. It’s about how people are treated: those within the organization, those who participate in its supply chain and those living in the communities in which the business operates.

Over 90% of the S&P 500 are now voluntarily reporting on ESG issues in some form, many using a mix of several of the ESG frameworks available (Center for Audit Quality study). Many organizations have also expressed a growing desire to pursue, and report on, strategic ESG initiatives aimed at moving the needle. They’ve come to see focusing on ESG as an opportunity through which to acquire or retain customers, attract and retain talent, and even innovate products and services. These businesses are taking their ESG agendas well beyond risk management or reporting and compliance concerns. Their leaders regard ESG initiatives as future-proofing for their organizations: not merely a task of reporting the status quo or checking a box, but a mission to change outcomes.

Staying focused: What do you want to accomplish?

As organizations consider what their ESG programs should accomplish, they will, of course, want to make sure they meet reporting requirements, too. Two-thirds of the S&P 500 companies voluntarily reporting ESG data use three or more of the available reporting frameworks, perhaps to accommodate the preferences of different consumers of ESG information, or perhaps to avoid insufficient reporting, given the lack of clarity on which of the many standards to use. (Some reporting standards are converging, helping redirect focus from reporting to actually sustainability behavior.)

Every organization will want to report improvements against goals with each reporting period, but better reporting isn’t the goal: Businesses must produce better outcomes in order to report better results. Therefore, leaders should ask what results their organizations are seeking to achieve. Goals should include all three of the “letters” — E, S and G — but prioritized in proportion to their relevance to the industry, geography and other attributes of the business. For example, an oil energy company that has decided to address diversity issues over the environmental impact of its business will likely raise eyebrows; on the other hand, favoring the S over the E would be an appropriate focus for an investment management firm in an industry where executive pay and gender inequality are areas of focus.

Businesses will want to create metrics and agree on the disclosures used to track and report their progress, but more importantly, those metrics and disclosures should tell a story, and hopefully one of change. Establishing goals and related metrics will focus the organization, and guide creation of an infrastructure to address the organization’s ESG priorities.

ESG skills and competencies

It’s important to consider the skill mix of the people entrusted with guiding ESG efforts — starting with the C-suite and the board. It’s less about having a clear-cut role and more about demonstrating a commitment to setting goals and standards, and then asking the right questions.

Focusing on ESG is, by definition, taking a more expansive view of a company’s risks and opportunities. It requires internalizing some factors that have always been externalities, and it’s forcing companies to think about things differently than they have historically. So, it is very important that people entrusted with ESG oversight have this broader perspective.

Beyond board and management, the day-to-day execution of ESG initiatives requires the involvement of people who have operational experience in ESG and sustainability issues as well as people with strategic business responsibilities. For ESG to scale and add value, it’s important that companies have extensive operational experiences on their ESG teams.

Looking ahead

We can have confidence that today’s ESG initiatives will yield meaningful results beyond the demonstrable sustainability of individual businesses. Many organizations we know have made specific 10-year commitments, and they’re not waiting until year 9 to show progress. They know improving reporting alone is an insufficient response to a global society that’s demanding real progress — and they’re working to attain better outcomes. They’ve begun to deliver results, and to convey what they’re achieving through credible reporting.

For more insights on the future of ESG, listen to the on-demand webinar. Visit VISION by Protiviti for additional articles, interviews and podcasts exploring this topic, and subscribe to the VISION by Protiviti newsletter for access to our latest Oxford-Protiviti survey report on the Future of ESG.

Read additional blog posts on The Protiviti View related to sustainable business.