The big picture: The National Association of Insurance Commissioners (NAIC), the standard-setting body for the U.S. insurance industry, recently updated its Climate Risk Disclosure Survey to include 22 new binary (i.e., yes-no) questions focusing on risk management. In July, the NAIC will email applicable insurers the Reporting Year 2022 Climate Risk Disclosure Survey, which must be submitted by August 31, 2023.

Why it matters: The new questions are optional this year but will be required in 2024.

- The survey is administered to U.S.- and non-U.S.-based carriers that are licensed in the survey’s 15 member states and jurisdictions and write at least $100 million in direct premiums.

Insurers should consider the following actions for compliance readiness:

- Adopt the Task Force on Climate-Related Disclosures (TCFD) as the baseline for your ESG program

- Embed the new questions in your materiality assessment

- Document your strategies for achieving affirmative responses

- Overcome ESG limitations insurers face

- Use the new questions to define data needs

- Conduct a gap assessment on underwriting and investment decisions

The bottom line: ESG regulations will remain a focus in the insurance industry as the relevance of climate risks heightens. Building out your organization’s strategy in connection with the upcoming NAIC requirement will position you to manage these risks.

Go deeper: Read our insights below.

The costs associated with natural disasters have risen significantly in the past several decades. Total damages due to disasters caused by natural hazards globally have increased nearly 350% from $52 billion annually in the 1980s to $232 billion over the last three years. It has become critical for insurance organizations to understand their climate-related risks and find opportunities for operational improvement.

Last year, over 50% of all organizations globally indicated they are increasing the focus and frequency of their reporting related to environmental, social and governance (ESG) issues, compared to only 28% the year prior. This uptrend comes amid stakeholder and regulatory pressure, including the Corporate Sustainability Reporting Directive (CSRD), which was approved by the European Union Council in November 2022 and will take effect in fiscal year 2024, and other anticipated climate-disclosure requirements globally, including from the U.S. Securities and Exchange Commission (SEC).

Insurers are increasingly being held accountable for industry-specific disclosures about climate risks through the National Association of Insurance Commissioners (NAIC), the standard-setting body for the U.S. insurance industry. In addition to U.S.-based insurers, the NAIC’s standards apply to non-U.S.-based insurers that write direct surplus lines business in the U.S. If an insurer fails to meet these standards, its rating, and therefore its reputation and revenue, stand to suffer.

In 2010, the NAIC adopted the Insurer Climate Risk Disclosure Survey to give its regulators insight into how insurers incorporate climate risks in their mitigation, risk management and investment strategies. Originally consisting of eight open-ended questions, the survey was recently updated to include 22 new binary (i.e., yes-no) questions focusing on risk management. In 2023, the new questions are optional, but they will be required in 2024.

The survey is administered to U.S.- and non-U.S.-based carriers that are licensed in the survey’s 15 member states and jurisdictions and write at least $100 million in direct premiums. The member states and jurisdictions include California, Connecticut, Delaware, the District of Columbia, Maine, Maryland, Massachusetts, Minnesota, New Mexico, New York, Oregon, Pennsylvania, Rhode Island, Vermont and Washington. The current adoption rate captures nearly 80% of the U.S. insurance market.

In July, the NAIC will email applicable insurers the Reporting Year 2022 Climate Risk Disclosure Survey, which must be submitted by August 31, 2023 (less than 60 days to respond) and will introduce the binary questions that come into effect next year. Organizations can reference the NAIC Climate Risk Disclosure Survey guidance document for additional information.

How can insurers prepare for this change?

Following are actions insurers can take to proactively ready themselves for compliance with the update:

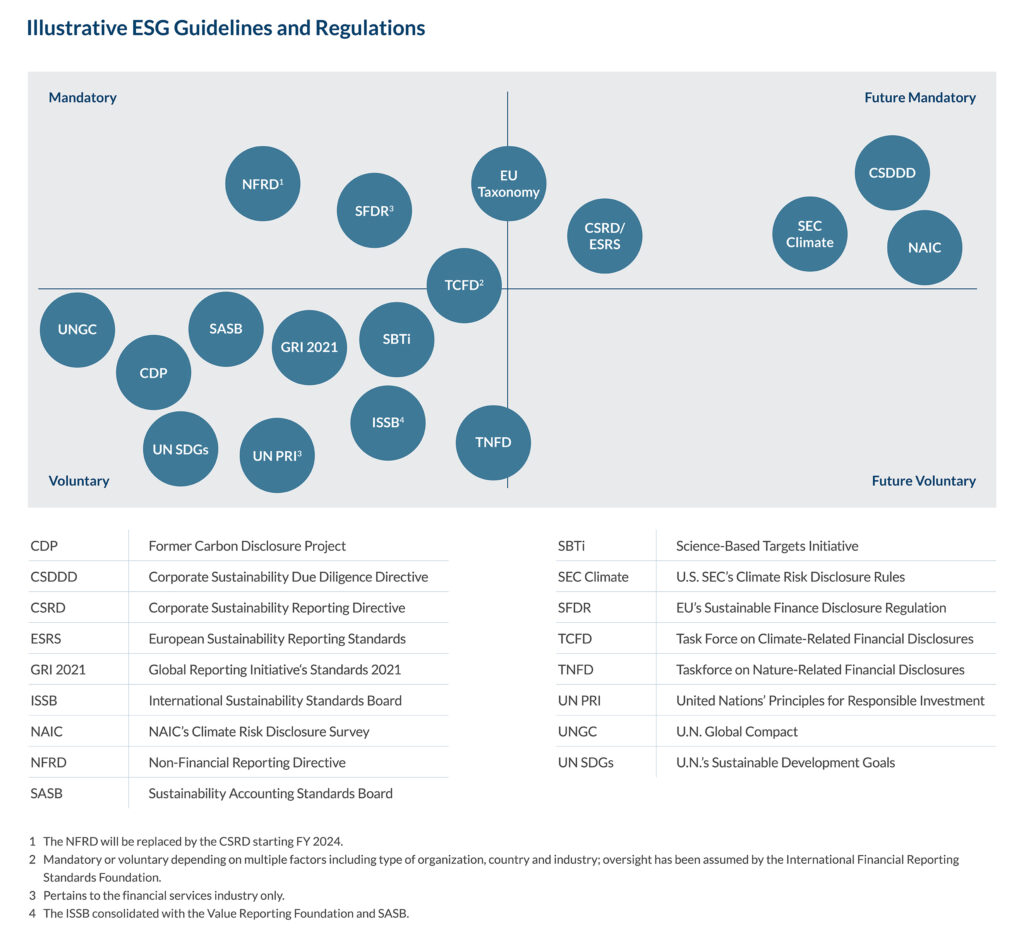

- Adopt the TCFD as the baseline for your ESG program: The new disclosures mandated by the NAIC add to the breadth of existing ESG guidelines and regulations (shown in the graphic below). However, the new questions will align with the core elements of the Financial Stability Board’s Task Force on Climate-Related Financial Disclosures (TCFD) framework: governance, strategy, risk management, and metrics and targets.

ESG regulations have increased by 155% over the past decade and by 647% since 2000. By establishing an ESG foundation and infrastructure around the TCFD framework, you set your organization up not only for compliance with the NAIC regulation but also to avoid building from scratch every time there is a regulatory update.

ESG regulations have increased by 155% over the past decade and by 647% since 2000. By establishing an ESG foundation and infrastructure around the TCFD framework, you set your organization up not only for compliance with the NAIC regulation but also to avoid building from scratch every time there is a regulatory update. - Embed the new questions in your materiality assessment: Refresh your materiality assessment to reflect the new questions, or, if you have not yet performed a materiality assessment, leverage the new questions as a starting point to initiate a materiality assessment. Socializing the new questions as topics material to your organization will promote a culture that prioritizes yes answers.

- Document your strategies for achieving affirmative responses: If your answer to multiple questions in the survey is no, consider how you can report a yes in the future. NAIC regulators will likely want insurance organizations to have more affirmative than negative responses, but they will also want to know what your plan is for getting to yes. Thoroughly document your strategies so that you meet the expectations of examiners and avoid enforcement actions.

- Overcome ESG limitations insurers face: Many insurance organizations lease their assets, resulting in a lack of control of emissions within their operations. This challenge underscores the benefit of identifying an ESG subject-matter expert and creating an ESG steering committee or task force to champion executing on the NAIC mandate effectively. To that end, mobilize individuals from functions across the organization, including underwriting, claims and loss control, along with the chief risk officer, the chief financial officer and the chief operating officer. Having these resources in place will also help you integrate broader ESG strategies, policies, components and solutions in your day-to-day governance structures, including at the board level.

- Use the new questions to define data needs: You cannot report or disclose an ESG metric you are not monitoring and measuring. Start by developing key risk and performance indicators that are relevant to the new questions and determine the data and data sources required to quantify them. Ensure that you are sourcing reliable, high-quality data that enables you to answer the questions accurately, understand roadblocks to affirmative answers and drive change in areas of deficiency, with a common goal of decreasing negative impacts and increasing positive impacts.

- Conduct a gap assessment on underwriting and investment decisions: Review your investment strategies and underwriting policies to evaluate alignment with the new questions. Where gaps exist, determine the best remediation effort or actions to pursue.

ESG regulations are here to stay and will remain a focus in the insurance industry as the relevance of climate risks heightens. Still, only 24% of insurers globally have mature or leading environment-related capabilities today. Building out your organization’s strategy in connection with the upcoming NAIC requirement will position you to manage these risks to better serve your customers, stakeholders and communities.