The big picture: On 31 July 2023, the European Commission adopted the European Sustainability Reporting Standards (ESRS), which support the Corporate Sustainability Reporting Directive (CSRD) with specific reporting guidelines for covered companies.

A key point: The ESRS are mandatory. They align with existing voluntary sustainability reporting frameworks from the International Sustainability Standards Board (ISSB) and Global Reporting Initiative (GRI) in an effort to optimize operability.

The bottom line: The final ESRS have more balanced provisions from the initial draft following a comment period. However, organizations must still assess whether environmental, social and governance (ESG) matters are material to their businesses, people and communities.

Go deeper.

The CSRD came into force in January 2023 – a pivotal legislation that is key to the EU’s Green Deal, which seeks to make Europe the first climate-neutral continent.

The ESRS supplement the CSRD, detailing what needs to be reported. The European Financial Reporting Advisory Group (EFRAG) in 2022 drafted the first set of standards, which then underwent revisions after a comment period. The European Commission adopted the final ESRS on 31 July 2023.

Usage of the ESRS is mandatory for companies that are obliged by the Accounting Directive to report certain sustainability information.

The ESRS strike a more moderate tone to ensure proportionality. They include additional phase-in provisions, gives companies more flexibility to decide what information is relevant to their circumstances, and has converted a limited number of mandatory standards from previous drafts to voluntary (with materiality being a guiding factor).

The Commission worked to align ESRS with the voluntary standards of the GRI and the ISSB in an effort to optimize interoperability. ISSB released its first two sustainability reporting standards (IFRS S1 and IFRS S2) on 26 June 2023. Earlier in the year, the Committee of Sponsoring Organizations (COSO) of the Treadway Commission also provided supplemental guidance on internal controls over sustainability reporting, which is designed to help companies under voluntary and mandatory reporting regimes govern decisions and disclosures related to sustainability reporting.

The European Parliament and EU Council have two months to scrutinize the ESRS but can extend the analysis period another two months. The bodies may reject the act, but they cannot amend it.

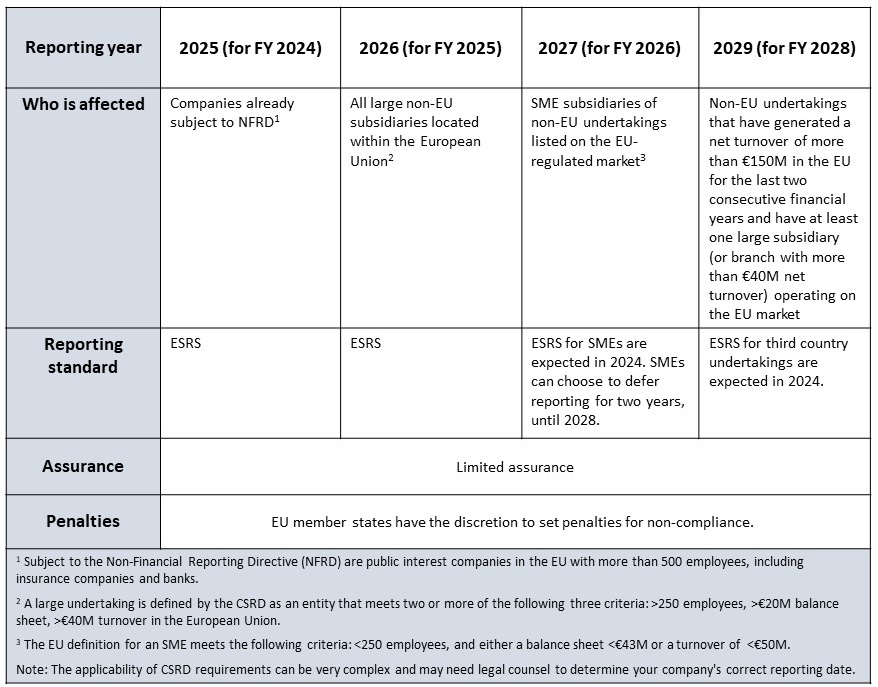

CSRD Reporting: Facts at a Glance

Reporting Parameters

The scope of sustainability information to be reported is based on the concept of “double materiality” – business impacts on people and the environment as well as environmental, social or governance factors that create financial risk and opportunities for the organization.

Further, all organizations that fall under the scope of CSRD are required to report on EU taxonomy – that is, they need to detail turnover, capital expenditures and operating expenses that are eligible and conform with the EU taxonomy definitions.

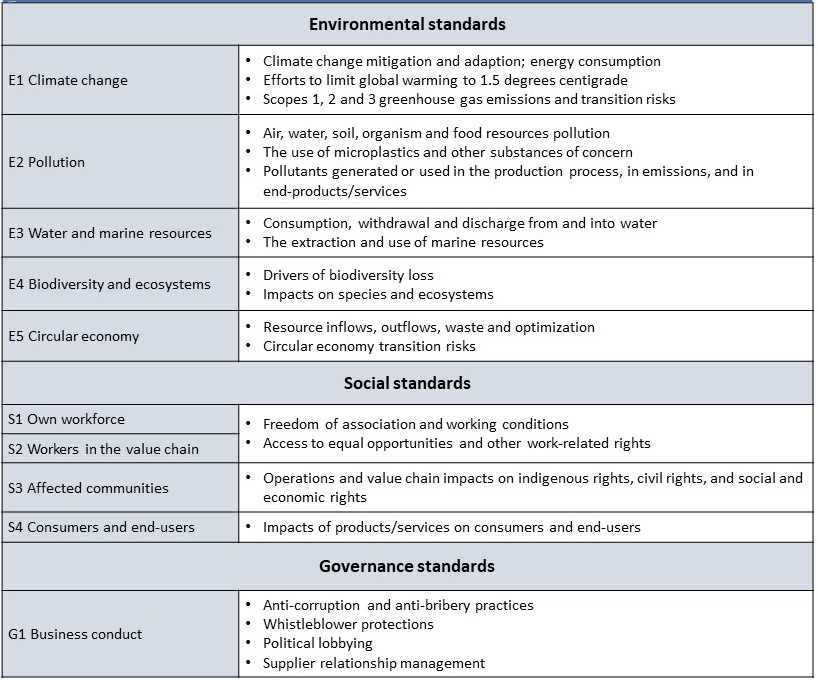

Structure of ESRS

The ESRS comprise 12 standards that cover the full range of sustainability issues – two cross-cutting standards and 10 topic-specific standards. Of the topic-specific standards, five are on environmental issues, four are on social impacts and one is on governance. Separately, forthcoming sector-specific standards are expected to create additional disclosure requirements related to industries such as oil & gas; coal, quarries and mining; road transport; agriculture, farming and fisheries, and others.

Cross-Cutting Standards

ESRS 1 (General Requirements) sets general principles to be applied when reporting. ESRS 2 (General Disclosures) specifies essential information to be disclosed irrespective of which sustainability matter is being considered. ESRS 2 is mandatory for all companies under the CSRD.

Topical Standards

Topical standards, individual disclosure requirements, and the data points within them are subject to a materiality assessment. This means that companies need to perform a robust materiality assessment to ensure proper disclosures.

Below is a brief non-exhaustive overview of the topical ESRS disclosure requirements:

Special Points of Focus

Materiality as the basis for sustainability/ESG disclosures

Materiality assessment is of strategic relevance when it comes to sustainability management and provides companies with a blueprint for sustainability/ESG strategies. Potential material sustainability matters relating to impacts on the outside world and financial impacts within an organization must be assessed.

Location of Reporting

The CSRD requires that sustainability reporting be in a specific section in the management report. It must be machine readable, and key figures and information will be transmitted and published in a standard digital format. Consequently, the sustainability information must be tagged in accordance with the European Single Electronic Format (ESEF).

Audit Requirement

To ensure reporting compliance, an independent auditor must confirm conformity with the standards. Limited assurance will be required initially, but over time, the CSRD foresees moving to a reasonable assurance threshold.

Implementation Guidance

To assist companies with implementation of the standards, the Commission has called on EFRAG to provide implementation guidance. Two draft guidance documents have been issued so far and are currently discussed within EFRAG: Value Chain Implementation Guidance and Implementation Guidance for Materiality Assessment. The guidance documents are complementary to the ESRS; they do not establish any new obligations. Their purpose is to provide clarity and answer questions to help address some of the key elements. They are not prescriptive with regard to any methodology for materiality assessment.

Final Thoughts

The CSRD and ESRS are introducing extensive sustainability disclosure requirements for more organizations than ever before. Companies must act quickly to prepare for the new regimen and treat it with the same import as financial disclosures. If they have not done so already, organizations need to make sustainability and ESG a priority of their business and decision-making models while establishing transparency into their activities, impacts and risks/opportunities.

To properly prepare, Protiviti suggests that organizations take the following steps:

- Assess the current status, prepare a double materiality assessment and establish a solid sustainability strategy to comply with upcoming reporting requirements

- Understand the required metrics responsive to that strategy and the reporting rules

- Establish the reporting structures for the ability to execute the strategy and produce the required information

- Establish a project plan to complete a compliant sustainability report

The adoption of the ESRS continues to foster consolidation of reporting frameworks – a welcome development. In applying the standards, companies should seize an opportunity to be not just compliant, but also impactful.

Britta Sadoun, Associate Director with Protiviti Germany, contributed to this content.