In brief: As regulators in Europe and the United States pump the brakes on mandatory sustainability reporting regulations, sustainability management emerges as a driver of business value on its own. Recent data shows executives are unwilling to drop sustainability from their agenda, regardless of the political winds and regulatory pull-back. Instead, they see sustainability as a way to build resilience, reduce risks, access capital and drive a competitive advantage for their organizations.

Background

The political pushback against and regulatory retreat from environmental, social and governance (ESG) regulations is real. After the U.S. Securities and Exchange Commission put its climate rule on hold last year, it announced in February this year that it would not defend it in court, effectively eliminating the first and only federal regulation on sustainability reporting in the US. Then, on February 26, 2025, the European Commission released a package of proposals (Omnibus proposals) that significantly scales down the Corporate Sustainability Reporting Directive (CSRD) and other European Union regulations such as EU Taxonomy and Corporate Sustainability Due Diligence Directive (CSDDD), removing many organizations from the scope of coverage and pushing deadlines for those remaining in scope in the future. As this happened, the first wave of large companies in Europe was already reporting under CSRD and had invested a significant amount of time and resources to prepare by gathering data and setting up governance structures and reporting systems.

These developments were not fully unexpected. The president of the EU Commission had made a pledge last year to ease the reporting burden for smaller organizations. The Omnibus proposals are a fulfilment of that pledge and only one part of the EU’s larger plan, known as the EU Competitiveness Compass plan, to boost competitiveness and growth. In the U.S., the SEC rule was controversial from the start and was voluntarily placed on hold by the Commission itself shortly after it was announced, amid legal challenges from industry groups and others.

Some companies reacted to the new political mood quickly by moving or downgrading their ESG targets. Coca-Cola pushed its recyclable packaging goals farther into the future and scaled down other waste reduction targets. Several major global banks left the Net Zero Banking Alliance in the beginning of this year without citing their exact reasons.

Why some are staying the course

Against this background, some organizations and investors are doubling down on the benefits of sustainability. According to a new global survey by Workiva, which polled 1,600 company executives across a broad spectrum of industries:

- 97% of executives say integrated financial and sustainability data helps them identify performance gaps that enhance financial growth opportunities.

- 85% will move forward with climate disclosures, regardless of political shifts.

- 93% of institutional investors are more likely to invest in companies with integrated financial and non-financial reporting.

In a Protiviti webinar we conducted in the wake of the Omnibus announcement, we asked participants whether they still plan to report sustainability information and why. Fifty percent of the participants said that sustainability is a strategic advantage for their organization and an important business driver, and another 18% said they do it for risk management reasons. These companies are seeing the upside of sustainability outside of the regulatory paradigm, as a business advantage on its own merit, and they are not wrong. A McKinsey study called decarbonization “the most significant opportunity in a generation: a potential $9 trillion to $12 trillion in annual sales by 2030 as capital and customer demand shift toward a low-carbon economy.” This is potential to be realized by those who keep moving forward.

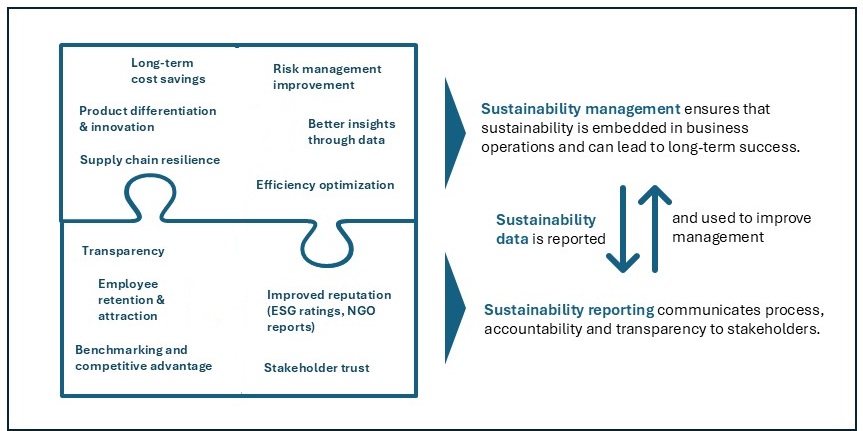

“The publishing of sustainability data is just one part of efficient sustainability management. Reporting and management are parts of the same puzzle and cannot be separated. This holistic approach to sustainability management brings multiple benefits.”

– Ellen Holder, Protiviti

The benefits of a holistic approach to sustainability management

An improved focus on metrics that matter

The “blessing in disguise” of the current regulatory retreat is an opportunity for organizations to take charge of their sustainability goals and strategy and measure and report the information that really matters to their stakeholders – and the business. Examples of the kind of information and metrics organizations are focusing on include:

- Metrics that could lead to clear cost efficiencies, such as waste, water, energy and materials reduction. These are easily measured through utility bills and bills of materials, and any savings add to the bottom line immediately.

- Metrics that matter to consumers (and employees) – GHG emissions, product sustainability, recycling rates, fair wages. Getting data in these areas requires a bit more effort — for example, to analyze individual processes, build databases or develop third-party inputs. Establishing robust data management processes is important to avoid serious accusations of greenwashing and the related penalties. Progress in this area can be a significant market differentiator, as well as position the company as an attractive employer for top talent.

- Metrics that matter to investors – climate risk exposure, resource availability and sustainability, stability of the labor force. It’s important that companies identify their main focus areas and use common standards and frameworks to answer questions from investors. A data management process needs to be established to ensure the data is reliable and verifiable.

- Supply chain metrics – these matter across the board, both from a cost-saving perspective and as an indicator of organizational values and operational resilience. Such metrics may include supplier energy usage (total vs. renewable), water intensity, materials circularity, sustainable packaging and human rights record. A requirement for these metrics can be embedded in supplier contracts and service level agreements after discussion with each supplier and any needed training or education.

How to move forward with purpose

As companies take a second look at their sustainability efforts and journey, we recommend the following steps to move forward with purpose:

- Identify your key drivers (compliance minimum level, expectations of internal and external stakeholders that are important to you, your double materiality topics)

- Perform a cost/benefit and SWOT analysis to determine your opportunities and costs

- Define or update your sustainability vision and mission

- Define or update your sustainability strategy

- Review your sustainability governance and processes; establish a sustainability data management practice

- Implement reporting structures according to international standards (e.g. TCFD, GRI)

Before all, we recommend that you remain steady during the regulatory turbulence and focus on the needs of your stakeholders and your organization’s values. Savvy business leaders know that sustainability is a long game. Cultivating an ESG mindset can help companies think critically about ESG and develop a holistic approach to this evolving long-term obligation.

Protiviti can help define sustainability goals and design and implement a data management and reporting structure to support those goals. Reach out to the authors or visit us.