Protiviti’s latest Finance Trends Survey, released yesterday, reveals the continuation of a significant shift in the priorities and activities of chief financial officers (CFOs) and senior finance executives. Over 70% of CFOs and vice presidents of finance view “strategic planning” as one of the highest priority areas in which they want to improve their knowledge and capabilities, highlighting the need for these finance leaders to focus on strategic matters as much as operational and day-to-day finance and transactional matters.

The Protiviti survey report, titled Today’s Finance Priorities: Security, Data, Analytics and Internal Customers, is based on a survey of 817 CFOs, vice presidents of finance, finance directors, controllers and other finance professionals at both public and private companies from around the world, and representing a wide range of industries. Fifty-eight percent of companies surveyed have revenues of US$1 billion or more.

Key Findings

Finance Professionals Prioritize Data Security

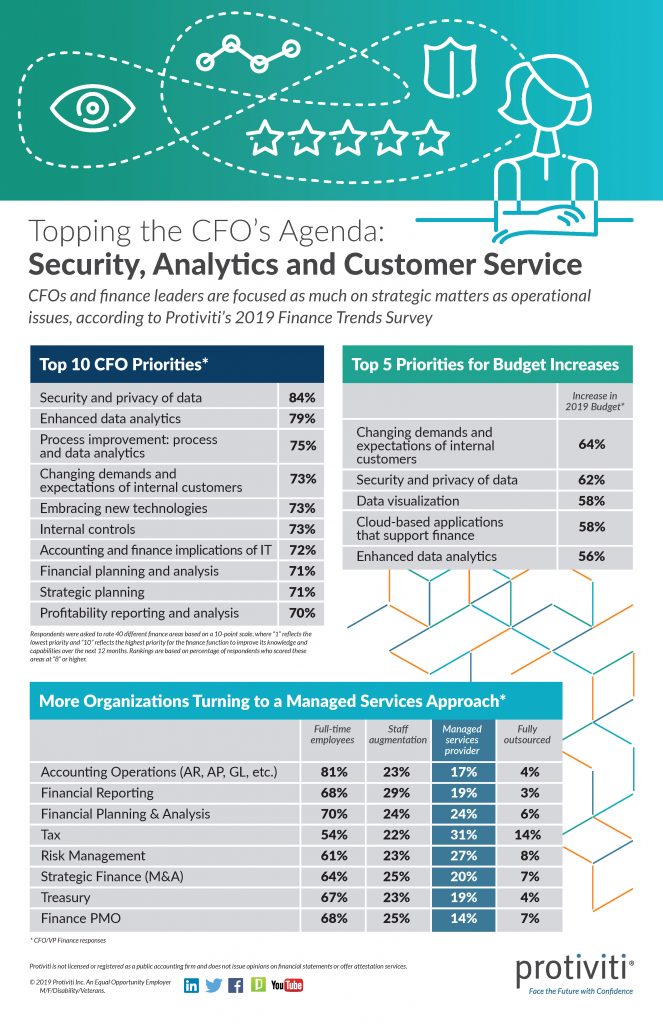

With the prevalence of data breaches hitting businesses today, security and data privacy are ranked as a priority for finance teams to focus on during the next year. Eighty-four percent of CFOs and VPs of finance and 77% of other finance professionals rated data security and privacy as a high priority, driven in part by the adoption of advanced technologies and cloud-based finance applications, and higher board expectations.

CFOs View Enhanced Analytics as Key to Their Internal Customers’ Needs

Strategic decision-making within organizations is being informed by data more than ever. As a result, the CFO’s internal customers are increasingly requesting that the finance function provide real-time information with specific insights, metrics and enhanced data analytics about the organization’s financial and operational performance. Nearly eight out of ten (79%) CFOs/VPs of finance and 70% of other finance professionals cited enhanced data analytics as a priority for the finance function to improve its knowledge and capabilities over the next year to help them exceed their internal customers’ expectations. Meeting the changing demands and expectations of internal customers is also a top area driving finance workforce increases.

Scaling the Finance Workforce Up (and Down) Helps Meet Demands

As a result of the changing demands and expectations of their internal customers, 61% of CFOs/VPs of finance plan to increase the finance function’s employee count in the next year. These respondents also cited cloud-based applications that support finance (49%) and data visualization (48%) as other priorities that are driving labor force expansions within the next 12 months. Of note, 28% of CFOs/VPs of finance plan to decrease their workforce in the next year due to efficiencies achieved through robotic process automation. However, other research from Protiviti, as well as recent news reports, suggests many companies are investing in long-term programs to reskill their existing workforces with new technology capabilities.

The Protiviti View will be posting in-depth discussions of these findings by Protiviti experts in the coming months. For more survey results, download a copy of the survey from our website. To register for our upcoming webinar to discuss the results of the survey on September 24, click here.

Read additional posts on The Protiviti View related to Finance Trends.