The first round of financials is coming in from large, non-calendar-year-end filers under new enhanced public reporting standards, and the public companies with later year-ends are examining those disclosures for trends that will help them complete the new Critical Audit Matters (CAMs) requirement under the new Public Company Accounting Oversight Board (PCAOB) auditing standard 3101 (AS 3101). Private companies preparing to go public in the next year would be well-advised to do so also, adding a review of these reports to their IPO readiness checklist as part of their broader public company transformation process.

Under the new rule, a CAM is any matter identified by an external auditor and reported to the audit committee that either required significant auditor judgment or has a material effect on financial statements. AS 3101 was adopted by the PCAOB in June 2017. It creates a new section of the auditor’s report in which auditors must list all of their major audit questions and assumptions, the specific accounts and financial statement disclosures to which they pertain, and how the matters were addressed by the audit committee.

The first round of reports, for accelerated filers with fiscal years ended June 30, 2019, were published in August. The next round of reports, for fiscal years ended through September 30, 2019, is coming out now. According to a Protiviti analysis of 92 reports submitted through October, auditors reported between one and four CAMs per report, for an average of 1.6.

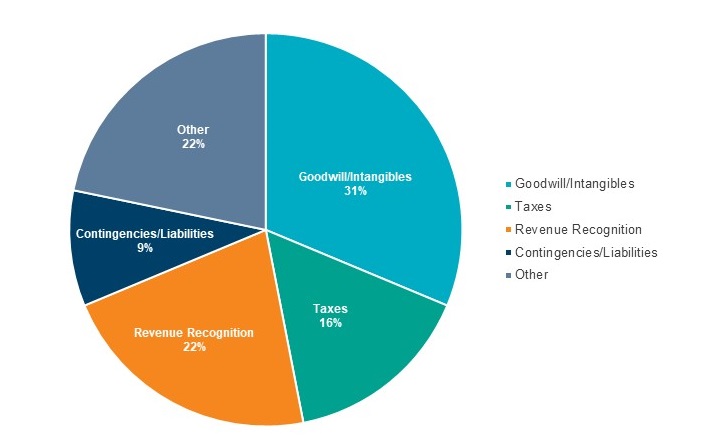

CAMs by type, based on Protiviti’s analysis of 92 financial reports submitted by October 31, 2019.

“Other” CAMs above include inventories, valuations, loan losses, IT/software, compensations/pensions, business combinations, and lawsuits.

CAMs to date seem to be coalescing around three major themes:

- Goodwill and intangible assets – for acquisitive companies, this byproduct of M&A activity was the most-frequently cited CAM, appearing in 50% of the reports in our analysis and accounting for 31% of all CAMs.

- Revenue recognition – Revenue recognition-related CAMs, so far, have been concentrated among tech companies and companies with a lot of long-term contracts.

- Income tax – The biggest challenges in this area appear to be international tax assumptions and estimates, likely related to the complexities associated with complying with, and accounting for, the changes made to U.S. tax laws at the end of 2017.

The remaining CAMs were miscellaneous valuations, estimates and assumptions that required auditors to use their judgment.

This sneak peek at what auditors are saying about the financial statements available so far is instructive because it offers some insights into some of the most challenging, subjective and complex judgments auditors face. Keep in mind, these filers are, arguably, the best equipped to comply with the new reporting rules because of their size and the complements of staff they employ to deal with financial reporting. Companies preparing to go public should use these insights to help them prepare for their first financial report, and the related audit.

If time and resources allow, we recommend working with your auditor to perform a dry run audit, to identify potential CAMs. This can be a beneficial exercise, not only when it comes to CAMs, but for IPO preparedness in general. For pre-IPO companies that haven’t yet formed an audit committee – another item on the readiness checklist – a CAMs dry run would be a good jumpstarting activity. External auditors can be a great resource for lessons learned or leading practices they have observed at public company peers.

CAMs are only one part of the broader public company transformation process. It is important to recognize that this is not a stand-alone operation and is best seen as just one item on the checklist — a list that never shortens. For a good overview of the full scope of the public company transformation process, check out Protiviti’s Guide to Public Company Transformation, which is available for download from our website.