Overview of top risk issues in 2022

While the CFO’s rapidly expanding collection of strategic concerns continues to defy expectations, the Top Risks Survey results for finance leaders reflect a fundamental dynamic of physics. Acceleration is directly proportional to force, according to Newton’s Second Law, which helps explain why the CFO’s role is transforming so swiftly.

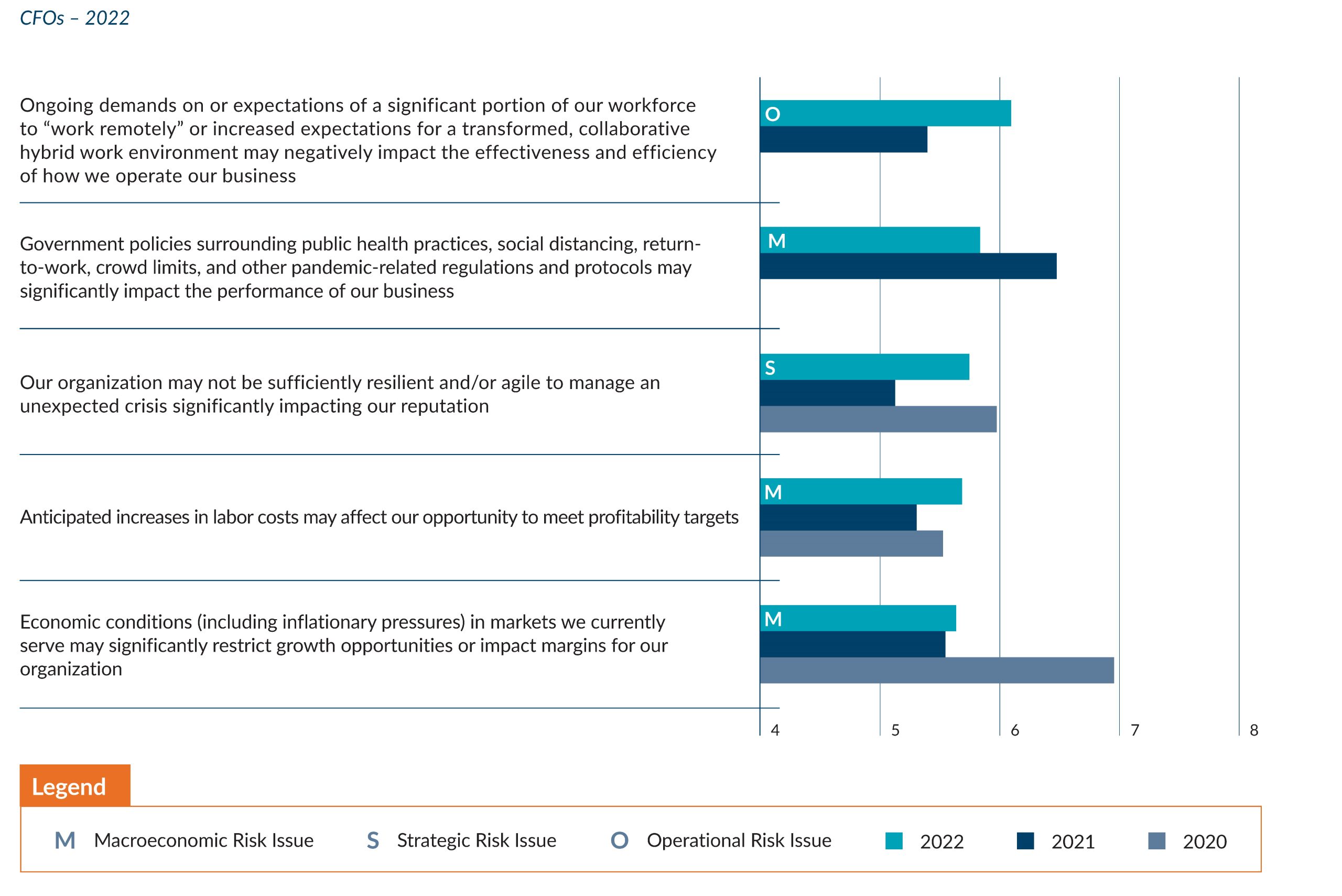

The past two years have seen rapid acceleration in the demands on businesses and their CFOs, driven for the most part by the global pandemic and its enduring and likely permanent effects, as well as by increasing organizational data needs, with CFOs being principal purveyors of that data. This certainly is reflected in CFOs’ top risk issue for 2022: demands on or expectations of a significant portion of the organization’s workforce to “work remotely” or in a hybrid work environment, which could impact business operations. Not only is this the top-ranked risk for CFOs, but its risk score jumped markedly from 2021.

Evolution in the workplace is creating uncertainty and the need for agility. The pandemic only accelerated trends that were already underway – specifically relating to remote work, e-commerce and automation. They have empowered many employees – particularly those whose physical presence in interacting with people and machines is not required at a specific location or in a specified environment – by giving them a desire for a voice and choice as to where and when they work, leading to various forms of a hybrid work environment for many companies. No one knows for sure what the post-pandemic norm will look like, and the number of companies implementing permanent work-from-anywhere policies continues to grow. More importantly, there is uncertainty over the impact of these changes on sustaining organizational culture and the way business is done.

Other fundamental changes broadening the CFO’s strategic purview – which increasingly encompasses organizational investments in talent, technologies, data, cybersecurity, product and service innovation, and culture – include the lingering pandemic and its ripple effects along with rapid technological advances. The pressure these forces exert, together with their acceleration, are intensifying: The risk-rating scores CFOs assign to nine of their top 10 concerns jumped markedly in the past 12 months.

From an operational perspective, in addition to challenges associated with remote work and hybrid working models, finance leaders continue to address numerous other pandemic-driven challenges posed by unyielding labor markets and associated rising costs, along with the impacts this ongoing workforce transformation has on organizational culture, change management activities, employee productivity and collaboration. Regarding culture, CFOs are particularly concerned about the degree to which talent- and workforce-related challenges will impede the organization’s ability to identify and escalate risk issues as well as to pivot the business model and core operations in response to those threats and opportunities.

From a strategic perspective, the organization’s resiliency in the face of pandemic-related challenges, social change and rapidly shifting customer expectations is among the top CFO concerns. Also of note: Falling just below the top five is the strategic concern that the organization may not be able to adapt its business model to embrace the evolving “new normal” resulting from the ongoing pandemic and emerging social change. It is understandable to see this risk issue among the top concerns for CFOs given their enterprisewide view of the organization’s risk profile and challenges, as well as their growing focus on meeting customer expectations. All of these issues, in the eyes of the CFO, underscore the importance of organizational resiliency.

While significant overlap exists between the CFO results and the top 10 risks that board members and C-suite executives identify at a global level, there are noteworthy differences in how each group rates and prioritizes different concerns. In terms of similarities, the global results also reflect a pervasive concern about resistance to change within organizational cultures as well as rising labor costs. CFOs, like other executives and directors, remain concerned about the impact of inflationary pressures and other economic tailwinds on profit margins and growth opportunities, especially as these challenges have only heightened since the survey was conducted in September/October 2021. CFOs also identify pandemic-related government policies and regulations as a top risk to business performance over the near term.

Compared to the overall results, finance leaders rate resiliency significantly higher – specifically, concerns that the organization may not be sufficiently resilient to manage an unexpected crisis. Cultivating greater organizational resilience through appropriate strategies, funding and structural mechanisms are among the top priorities for CFOs in 2022 and beyond.

Among some of the specific differences between the CFO results and those from other C-suite executives:

Among some of the specific differences between the CFO results and those from other C-suite executives:

- CFOs view the ongoing demands on or expectations of a significant portion of their workforce to “work remotely” and the resultant effects on the business to be a “Significant Impact” risk (denoting a risk score of 6 or higher on our 10-point scale), whereas a number of other executives – including board members, CROs and CAEs – rate this risk issue at a lower level.

- While CEOs, CIOs/CTOs, CSOs and CDOs view pandemic-related government policies and regulation impacting business performance as a “Significant Impact” risk, CFOs view this risk to have somewhat less of an impact on their organizations (though this is still a top five risk issue for CFOs).

- CEOs view access to sufficient capital and liquidity to be a “Significant Impact” risk issue, whereas CFOs rate this lower – this is an area, in particular, that CFOs should plan further dialogue with their CEOs.

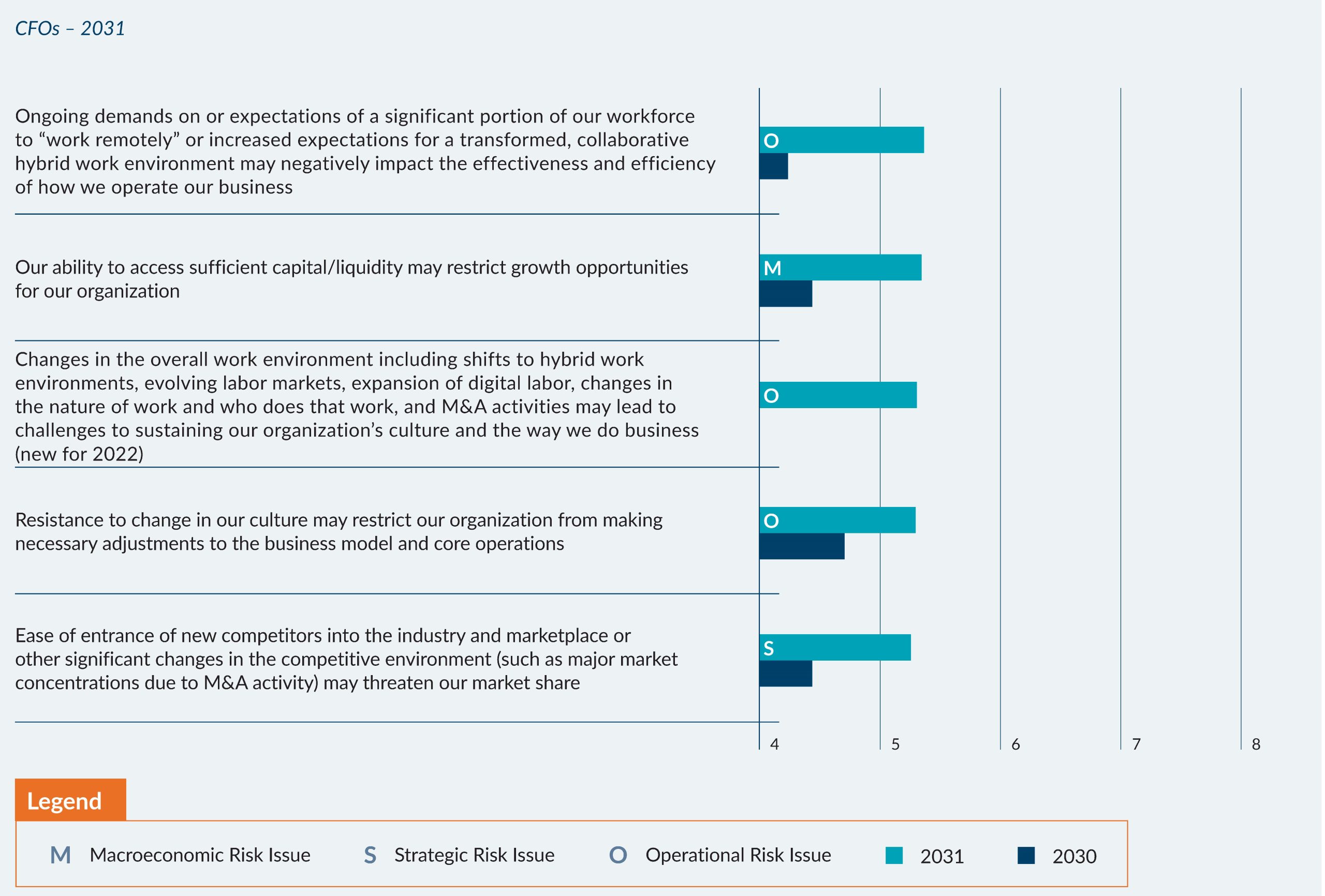

Overview of top risks for CFOs in 2031

While finance leaders generally – and understandably – rate the magnitude of their concerns over the risk issues assessed in our study to be lower over the next decade compared with their views for the next 12 months, the 10-year outlook scores provided by CFOs in this year’s survey are notably higher than these same scores from our 2021 study. For CFOs, it appears the long-term future looks more daunting today than it did a year ago.

The pandemic will recede at some point, but COVID-19 disruptions have sparked workforce transformations that organizations will need to manage on an ongoing basis well into the coming decade and likely on a permanent basis.

Interestingly, in 2031, CFOs expect to still be contending with challenges stemming from remote work and hybrid models. They also anticipate these fundamental workforce shifts to pose long-term challenges to the organization’s culture and particularly its ability to facilitate business agility, as well as to the timely identification and escalation of risk issues and market opportunities. These priorities reflect an expectation among finance leaders that the pandemic will affect businesses in many different ways over the long haul, and that the process of developing hybrid work models is likely to evolve over time.

In a decade’s time, finance leaders expect to remain as focused as ever on liquidity and the extent to which working capital can fund growth opportunities and fend off new marketplace entrants. CFOs also anticipate economic conditions, including inflationary pressures and other tailwinds, to linger as ongoing obstacles to profit margins and growth opportunities.

Concerns pertaining to economic conditions are shared by directors and executives in companies of all sizes. Similar to the perspectives among CFOs, the global results regarding the 10-year risk outlook reflect a heightened concern about fending off competitors’ innovative new offerings that have the potential to threaten an organization’s viability.

In closing

In recent years, CFOs have taken on a growing list of strategic responsibilities, including right-sizing the organization’s labor and talent investments, bolstering cybersecurity and data governance, and equipping a growing collection of internal customers with forward-looking financial insights. Thus it’s no surprise that post-pandemic talent management challenges, organizational culture risks and resilience represent rising risk priorities over both the short and long term.

It doesn’t take an advanced degree in physics to figure out that the CFO’s strategic responsibilities and concerns will continue to expand and accelerate.

Interested in learning more? In this 10th annual survey, Protiviti and NC State University’s ERM Initiative report on the top risks on the minds of global boards of directors and executives in 2022 and over the next 10 years into 2031.