What to watch: ESG metrics and measurement – and, by extension, reporting – are the highest priority areas for CFOs and their finance groups to address this year. This holds true among a number of industry segments, including manufacturing and distribution.

Yes, but: If any manufacturing leadership teams are waiting to implement the SEC’s final rules on climate disclosures before recalibrating their ESG reporting capabilities, they need to reconsider.

The CSRD is here: The CSRD ushered in a new, higher-stakes ESG compliance era when it took effect in January 2023. Its far-reaching reporting requirements will require many manufacturing companies – based in the EU as well as the United States and the rest of the world – to overhaul, rather than modify, existing ESG reporting capabilities.

Time to take action: Manufacturers should respond quickly and comprehensively to these requirements.

———————————–

Environmental, social and governance (ESG) metrics and measurement – and, by extension, reporting – are the highest priority areas for CFOs and their finance groups to address this year, according to Protiviti’s latest Global Finance Trends Survey. This holds true among a number of specific industry segments, including manufacturing and distribution. But if any manufacturing leadership teams are waiting to implement the U.S. Securities and Exchange Commission’s (SEC’s) final rules on climate disclosures before recalibrating their ESG reporting capabilities, they need to reconsider.

That’s because the Corporate Sustainability Reporting Directive (CSRD), issued by the European Union (EU), ushered in a new, higher-stakes ESG compliance era when it took effect for many organizations in January 2023. The CSRD’s far-reaching reporting requirements will compel many manufacturing companies – based in the EU as well as the United States and the rest of the world – to overhaul, rather than modify, existing ESG reporting capabilities.

Manufacturers should respond quickly and comprehensively to the CSRD for several reasons:

- Manufacturing companies around the world will be subject to CSRD reporting requirements. More than 50,000 EU-based companies and more than 10,000 non-EU enterprises (a third of which are based in the United States) will be subject to CSRD compliance by no later than 2026. Beyond this group, thousands of other manufacturers will be affected indirectly as in-scope companies issue requests for ESG data from their vendors, customers and other trading partners.

- Sprawling operations and supply chains pose unique CSRD compliance challenges. The CSRD requires companies to assess and report their environmental and social impacts throughout their entire value chains. In addition to managing complex supply chains, many manufacturing companies operate multiple locations across different countries. The systems (and ESG data they contain) in all those locations are rarely integrated in an optimal way.

- More ESG requirements are in place or on the way. Beyond the SEC’s final climate impact disclosure rules (which the SEC passed but placed on hold, pending ongoing litigation), many manufacturers are subject to new ESG reporting requirements from the EU’s Fit for 55 package and its Carbon Border Adjustment Mechanism (CBAM) The CBAM’s reporting requirements also took effect in January 2023, and the directive’s new carbon tax on imports of products made from processes deemed environmentally unsustainable takes effect in 2026. In the United States, the Inflation Reduction Act features a mix of new environmental taxes as well as major incentives to promote renewable energy and decreases in greenhouse gas (GHG) levels. Also in the United States, new climate disclosure requirements in the state of California are expected to have far-reaching effects not only for the U.S.-based businesses that are required to comply but also for their trading partners around the world.

- The CSRD and other ESG reporting mandates also present opportunities. CSRD data, which ultimately must be auditable and attested, can be used in marketing activities and also may provide recruiting and retention benefits. Supply chain-related data collection activities will give trading partners a better understanding of each other’s priorities, needs and strengths. This mutual understanding can help drive sustainable sourcing efforts.

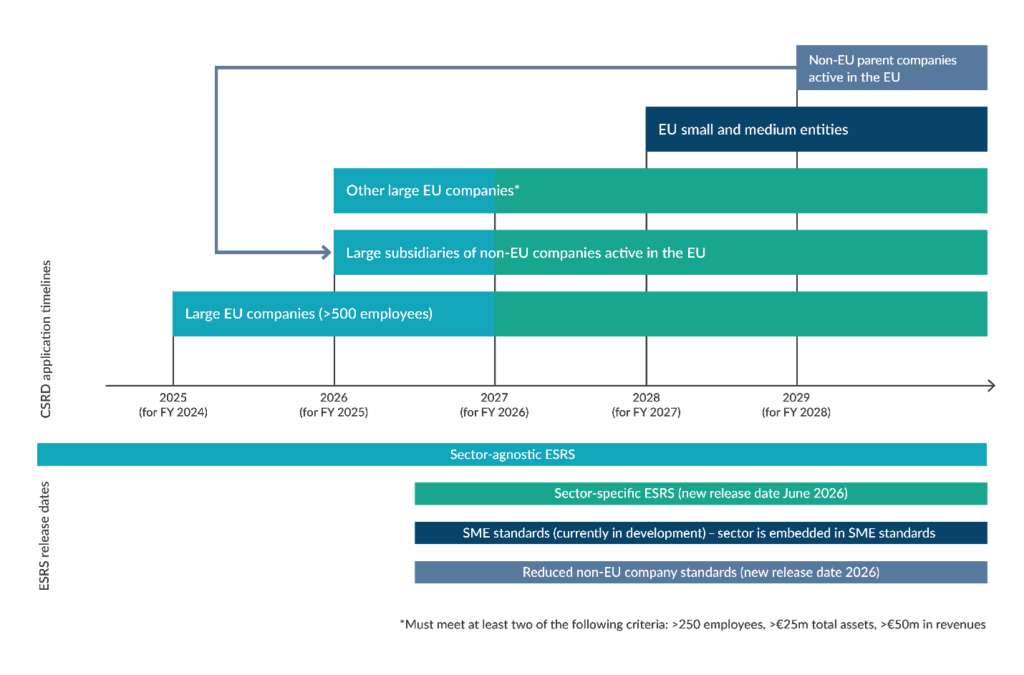

The following graphic illustrates the timeline for CSRD compliance.

Figure: Timeline of CSRD compliance

Double Materiality Is a Big Deal

The CSRD’s extensive data collection and reporting requirements are being phased in over time. Some companies will need to disclose as many as 1,000 discrete items. All companies within the scope of the CSRD will need to report on ESG performance based on their adherence to 12 European Sustainability Reporting Standards, which include two overarching standards, five environmental standards, four social standards and one governance standard. Developing a CSRD compliance capability requires substantial data collection and verification, cross-functional collaboration, new internal controls, and a new reporting infrastructure.

The directive’s double materiality analysis requirement is especially noteworthy, given its breadth and its role as a foundational compliance building block.

The first materiality analysis the CSRD calls for is an “outside-in” assessment of external ESG-related risks that may affect the organization’s operations and enterprise value. For example, a textile manufacturer may need to assess its ability to access water and other production inputs given climate-related stresses on water supplies. The CSRD’s second materiality analysis mandates an “inside-out” evaluation of a company’s environmental and social impact on the world. Again, these impacts must be assessed throughout the value chain, from sourcing and manufacturing processes to the delivery of services and the use and disposal of products. Traditional, single materiality analyses are routine and primarily mathematical in nature. Double materiality analyses require more qualitative assessments of what needs to be reported.

Two Moves to Make Now

Some manufacturing and distribution companies (specifically, those based in the EU) may be required to issue reports as early as 2025, using 2024 data, and will have substantial ground to cover. Two areas require immediate attention:

- Determining the level and scope of reporting: While companies required to comply with the CSRD will eventually produce a single, consolidated global report, this probably won’t be the case for the next few years, when individual reports can be issued for each legal entity that is in scope. Some companies may elect to bypass the intermediate step of issuing reports only for in-scope legal entities and instead issue a comprehensive global report. Other organizations will choose to disclose at the (in-scope) entity level and wait to produce a global report until that is required. Still others may opt to issue a regional report. Each approach has pros and cons that must be considered in conjunction with each company’s unique ESG performance and double materiality assessments. For example, if only one of a manufacturer’s 20 EU legal entities is in scope, it may be prudent to hold off on the global report.

- Focus on strengthening data collection rigor and controls: The ESG data needed to complete CSRD disclosures is typically unstructured, stored in different formats, and pulled from numerous systems, applications and sources throughout the company and its third parties. In many cases, the data is stored in unfamiliar sources and managed by individuals and teams that possess limited knowledge of internal controls and public reporting. This data also must be trusted, accurate, complete and well-defined. Addressing this need represents a massive challenge inside most companies, particularly manufacturers, given that the range of data sources used in CSRD reporting is considerably broader than the collection of data used in financial reporting. In most organizations, financial data governance and management is far more sophisticated than their current ESG-related data governance and management processes.

Whether it’s January 2025 or 2026, the date is closer than it might appear given the amount of work required to build a new CSRD compliance capability. This is particularly true for manufacturers considering that they may have in-scope entities in the form of plants and warehouses, even though the organization itself may be based outside the EU. Determine your specific compliance date ASAP – even if it has been delayed, begin preparation now, given the amount of work required.

For additional information, consult Protiviti’s free online FAQ Guide of more than 80 commonly asked questions about ESG compliance, from strategy and governance to data and reporting.